Omnichannel Payment Flows: Syncing In-Store Payment Methods with Online Accounts

İçindekiler

Creating Seamless Retail Journeys Across MENA’s Digital and Physical Touchpoints

The way customers shop in the Middle East and North Africa has changed. Buyers no longer think in terms of online versus offline. Instead, they expect a single, fluid experience—whether browsing a website in Jeddah or walking into a store in Dubai.

What supports this smooth experience behind the scenes? Omnichannel payment flow—a critical part of any omnichannel order management system.

This article explores how MENA retailers can connect in-store payments with online accounts to enhance transparency, streamline operations, and meet the modern consumer’s expectations.

Quick Bytes for Busy Minds

- Linking in-store payments to online accounts improves the customer journey

- Real-time sync reduces errors and accelerates refunds

- Connected systems support digital wallets, cards, and cash

- Omniful’s Order Management System helps retailers align payment flows with fulfilment

- Unified payment visibility supports returns, loyalty, and compliance

Changing Consumer Expectations in MENA

Customers today expect more than a receipt. They expect access.

From Riyadh to Cairo, a growing number of shoppers want to:

- View their full payment history online

- Use loyalty points whether they shop online or offline

- Return a product purchased in-store via a digital return portal

- Use payment methods like Apple Pay or local wallets seamlessly across channels

If your systems don’t talk to each other, your customer service falls short. This makes synchronising payment flows not a nice-to-have, but essential.

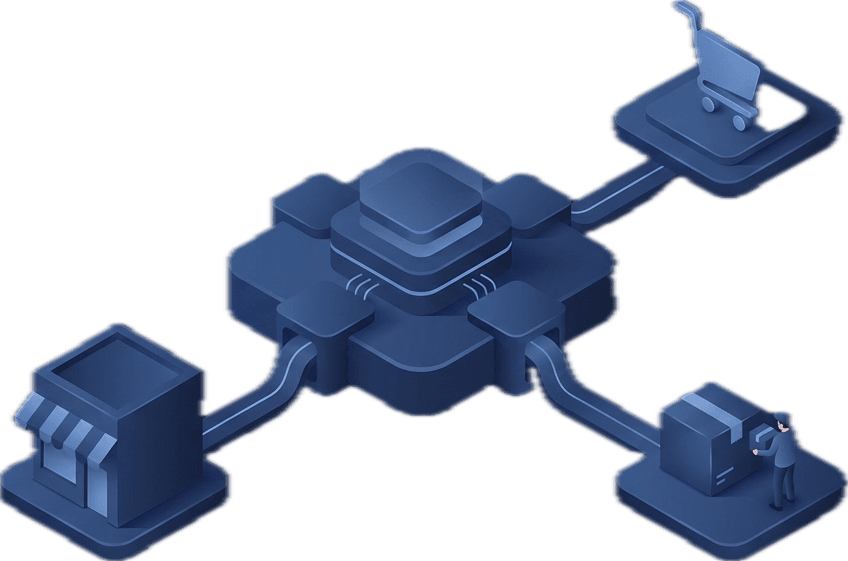

What Is an Omnichannel Payment Flow?

An omnichannel payment flow refers to a retailer’s ability to process and record transactions across all sales points—physical and digital—in a connected way.

Key characteristics:

- In-store payments are linked to the customer’s online account

- Online purchases reflect in customer profiles used in-store

- Refunds or returns can be initiated and completed from either channel

- Promotions or loyalty offers apply regardless of how or where the payment was made

This integration removes the silos between your sales systems and gives shoppers the unified experience they expect.

Why Syncing Payments with Accounts Matters

Disconnected systems cause friction. For example:

- A customer pays in-store, but the transaction isn’t visible in their app

- A loyalty voucher used online doesn’t register at the cashier

- Returns require manual receipt checks

- Refunds are delayed due to mismatched records

By using a robust order management system for omnichannel retail fulfillment, these issues can be avoided. Omniful’s platform is designed to centralise orders, payments, and fulfilment data in one ecosystem.

The Role of an Omnichannel Order Management System

An order management system (OMS) does more than track sales. In a true omnichannel retail setup, it acts as the hub for:

- Order lifecycle tracking

- Payment capture and verification

- Return and refund management

- Loyalty points and voucher updates

- Customer identity mapping

A unified OMS ensures that when a customer pays with their mobile wallet at your store, that transaction syncs with their online account instantly.

Omniful’s OMS provides this real-time bridge between systems, creating a single source of truth.

In-Store Meets Online: Payment Scenarios That Work

Let’s explore how payment sync plays out in daily transactions:

Scenario 1: Buy Online, Pay In-Store A customer places an order on your website and selects “Pay in-store.” They visit your outlet, make the payment via card or wallet, and the system instantly marks the order as fulfilled.

Scenario 2: In-Store Purchase, Digital Record

A walk-in customer pays by card. Their phone number is entered at checkout. The payment, receipt, and loyalty data are then accessible via their online profile.

Scenario 3: Online Return of In-Store Purchase

A product bought in-store is returned using the online portal. The OMS processes the return, updates the refund status, and adjusts loyalty points—all without manual steps.

This level of integration is only possible with synchronised payment flows.

Tools That Enable Payment Sync

POS System Integration

Your Point of Sale system must connect with your digital platform. This allows:

- Payment data to update in real time

- Customers to be identified via phone/email

- Inventory levels to adjust instantly

- Digital receipts to be sent automatically

Customer Identity Unification

Use mobile numbers, loyalty IDs, or digital wallet tags to ensure each payment connects to the right account, regardless of the channel.

API-Driven Payment Gateways

Support for regional payment systems is essential:

- KSA: Mada, STC Pay

- UAE: PayBy, Tabby

- Egypt: Fawry, Meeza

Omniful’s Plug-and-Play Integrations make it simple to support these gateways across online and in-store checkouts.

Advantages of Real-Time Payment Synchronisation

-

Faster Refunds and Dispute Handling: Linked payment data allows refunds to be processed faster and disputes to be resolved with clear records.

-

Improved Customer Loyalty: When customers see their purchases and rewards in one place, they’re more likely to stay loyal.

-

Easier Reconciliation: Centralised payment reporting reduces accounting effort and error rates.

-

Better Fraud Prevention: Syncing transactions with verified user profiles reduces the risk of fake refunds or duplicated vouchers.

The MENA Perspective: Regional Readiness

Retailers in the region are already making strides. Payment behaviour is shifting:

- Digital wallet usage is increasing across all age groups

- Buy Now, Pay Later (BNPL) services are becoming mainstream

- Regulatory changes are encouraging digital record-keeping

Integrating these trends with your OMS prepares your business for cross-border trade, investor compliance, and customer trust.

Use Case: Grocery Chain in Riyadh

Problem:

Customers paying in-store couldn’t track their spending on the mobile app, affecting loyalty redemption and refund claims.

Solution:

The retailer implemented Omniful’s POS and OMS integration. All payments were synced to customer profiles using phone number verification at checkout.

Result:

- 95% of in-store payments now reflect online

- Refund time reduced by 60%

- Loyalty usage increased by 40%

- Customer service calls on refunds dropped by half

Metrics to Monitor Success

To gauge the effectiveness of your omnichannel payment strategy, track:

- % of in-store payments linked to online profiles

- Time taken for refunds across channels

- Volume of cross-channel returns

- Reconciliation error rate

- Repeat purchase rate post-implementation

Omniful’s dashboard allows you to filter these by region, store, and payment type.

Avoiding Common Mistakes

- Not capturing customer info in-store: Without identifiers, sync is impossible

- Lack of training for in-store staff: They must understand how to enter customer data correctly

- Unsupported payment gateways: Ensure all platforms accept the same methods

- No fallback for offline stores: Use mobile apps that sync once online

Plan thoroughly and test every scenario.

Future Trends in Payment Flow Integration

- QR code receipts linking physical bills to digital profiles

- AI-assisted fraud checks across channel history

- Dynamic promotions triggered by cross-channel behaviour

- Instant tax invoices synced for VAT compliance in Saudi Arabia and UAE

These innovations require a foundation built on real-time, omnichannel data flow—starting with payments.

Take the First Step Toward Omnichannel Retail Excellence

📦 Try Omniful’s Order Management System

🏪 Modernise Your POS Integration

🔗 Seamlessly Sync Gateways and Systems

FAQs

What’s the biggest benefit of syncing in-store payments with online profiles?

It creates a unified shopping experience that supports better service, returns, and loyalty programmes.

Is this suitable for cash payments?

Yes. With manual entry and account linking, even cash transactions can be tracked digitally.

Does it work across multiple store branches?

Absolutely. Centralised OMS and POS tools make it easy to unify payment records from various locations.

Can I offer discounts based on payment history?

Yes. Once all transactions are linked, targeted promotions based on purchase patterns become possible.