Bonded Warehouses: Understanding Benefits & Best Practices

Table of Contents

Introduction to Bonded Warehouses

Definition and Purpose of Bonded Warehouses

A bonded warehouse stores imported goods which enables businesses to defer tax payments by not paying import duties immediately. International trade businesses gain advantages through these facilities by postponing duty payments until their products enter the market or leave the country. The bonded warehouse industry features two primary classifications that serve distinct business requirements by way of public bonded warehouses and private bonded warehouses. Public bonded warehouses provide shared storage options, and private bonded warehouses offer dedicated storage space for distinct licensees.

Overview of Customs Regulations for Bonded Warehouses

Customs bonded warehouses function according to rigorous customs regulations. Customs authorities supervise all goods stored in bonded warehouses to ensure legal compliance. Goods can only be stored in customs bonded warehouses after importers have received the required approvals and executed a bond. The bond guarantees payment of duties upon releasing stored goods from the warehouse. The system enables efficient international trade operations while maintaining compliance requirements, which makes bonded warehouses vital to global logistics networks. Utilising bonded warehouses allows businesses to streamline their import operations while enhancing security and managing cash flow more effectively.

Benefits of Using a Bonded Warehouse

Deferred Payment of Customs Duties and Taxes

Utilising a bonded warehouse offers businesses the most significant benefit of postponing their import duties and tax payments. Companies may hold their inventory in customs bonded warehouses without paying duties until they distribute the products to domestic markets or export them to foreign destinations. The deferment provides instant cash flow benefits for companies through the reallocation of funds to critical business operations and strategic growth areas. Businesses gain particular advantages when they can postpone duty payments until they sell or ship their products because this practice helps companies with low-profit margins and those importing expensive items.

Cost Savings for International Businesses

Companies experience considerable cost savings when using bonded warehouses. International firms achieve major financial advantages when they postpone their import duty and tax payments. Companies involved with high duty rate imports together with those that maintain narrow profit margins achieve major benefits from these payment arrangements. By postponing their duty payments, companies gain additional resources for revenue-generating functions, including product development and marketing. Exporting goods directly from bonded warehouses eliminates the need to pay duty charges, potentially resulting in tax savings as high as 30%.

Enhanced Security and Compliance

Bonded warehouses deliver advanced security and compliance measures, which enable businesses to store their valuable goods with peace of mind. CCTV cameras operate alongside access control systems and intrusion detection technology in bonded warehouse security systems to deliver sophisticated protective solutions. Customs authorities enforce stringent supervision protocols which protect stored goods through regulatory compliance and reduced risks of theft & damage. Secure storage solutions from public and private bonded warehouses serve companies that manage valuable and sensitive inventory. Bonded warehouses enable international trade businesses to defer duties while saving costs and enhancing security through adaptive storage facilities.

Types of Bonded Warehouses

Public Customs Bonded Warehouses

Public bonded warehouses function as customs bonded warehouses where importers can share storage facilities. Private enterprises operate warehouses where multiple clients gain shared cost advantages and operational flexibility. Public bonded warehouses offer cost efficiencies that benefit businesses which do not require their own private storage space. Imported goods can be stored in bonded warehouses without immediate import duty payments which allows companies to postpone these expenses until the products hit the market or reach international destinations. Public bonded warehouses stand out as popular storage choices for companies looking for cost-effective solutions.

Private Bonded Warehouses

Imported goods storage operations in private bonded warehouses remain under the full control of companies and businesses who own these facilities. Companies benefit from the dedicated storage space at these facilities because it supports better inventory management and operational efficiency. Specialised storage conditions and independent product management systems in private bonded warehouses deliver advantages to large importers. By keeping products in bonded warehouses, businesses can delay their import duty payments which helps them manage their cash flow by postponing payment obligations.

Foreign-Trade Zones (FTZs)

Imported merchandise can be stored and handled in Foreign-Trade Zones by manufacturers and distributors tariff-free until it reaches domestic consumers. Foreign-Trade Zones exist as special areas adjacent to entry ports where customs procedures do not apply to enhance import and export activities. International trade firms utilise Foreign Trade Zones to delay customs duty payments which enables them to enhance logistics operations and reduce operating expenses. Companies operating in FTZs enhance their supply chain performance and expedite market entry by avoiding initial duty payments on products intended for re-export.

Considerations for Choosing a Bonded Warehouse

Location and Accessibility

The location of a bonded warehouse becomes the fundamental deciding factor during selection. Businesses need to position bonded warehouses close to ports and airports to reduce transportation costs and improve logistical efficiency. When a site location is closer to the target destination, it speeds up merchandise transport, resulting in reduced lead times and better supply chain performance. Public bonded warehouses are essential for businesses to establish links with transportation networks which enables efficient management of import and export activities. Companies optimise their logistics operations and delay customs duty payments through the strategic selection of customs bonded warehouses.

Custom Regulations and Tax Benefits

Understanding customs regulations is essential for businesses when they choose a bonded warehouse. These facilities must store goods securely while fully complying with all current legal requirements according to strict customs regulations. The use of bonded warehouses allows businesses to postpone import duties and tax payments until goods enter free circulation. Payment deferral allows companies to manage their finances more flexibly as they allocate resources to strategic business operations.

Facility Security and Handling

Businesses need to assess bonded warehouse security as well as management strategies because they serve as essential components for operations. Warehouses protect stored goods through security systems that feature both surveillance and access control measures. Maintaining safe storage conditions for goods through proper inventory management practices and correct handling methods leads to efficient operations and damage prevention. Robust security systems safeguard company inventory in bonded warehouses while companies enjoy financial gains through postponed duty payments.

Best Practices for Utilising a Bonded Warehouse

Proper Documentation and Reporting

Successful management of a bonded warehouse demands precise and comprehensive documentation as the most important practice. Businesses need to maintain all records like bills of lading and inventory logs along with customs forms in detail to satisfy customs regulations. Accurate reporting in customs bonded warehouses helps avoid fines and prevents delays when releasing merchandise. Importers must submit monthly reports for public bonded warehouses that monitor both item storage and their movements. Through record management systems that enable transparent operations, it becomes possible to defer payment of import duties and taxes, which provides substantial financial benefits from bonded warehouse storage.

Regular Inspections and Compliance Checks

Customs bonded warehouse operations require routine inspections and compliance checks to verify regulatory standards compliance for stored goods. Customs officials conduct regular facility inspections to ensure stored goods adhere to security requirements & legal regulations. Businesses operating in public bonded warehouses need to perform regular internal audits to adhere to customs regulations and protect the integrity of their storage operations. Companies prevent fines and delays while maintaining bonded status by proactively resolving any discrepancies.

Optimising Storage Efficiency in Bonded Warehouses

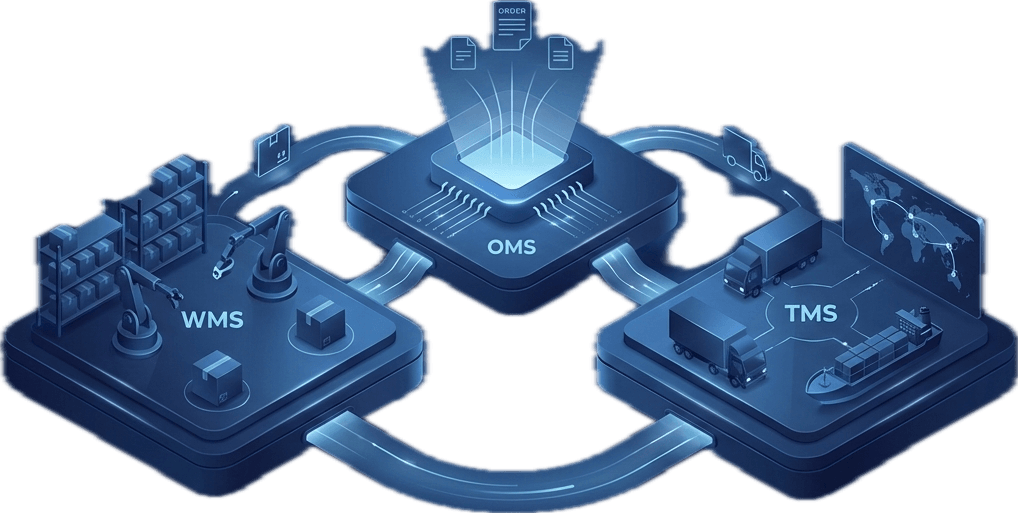

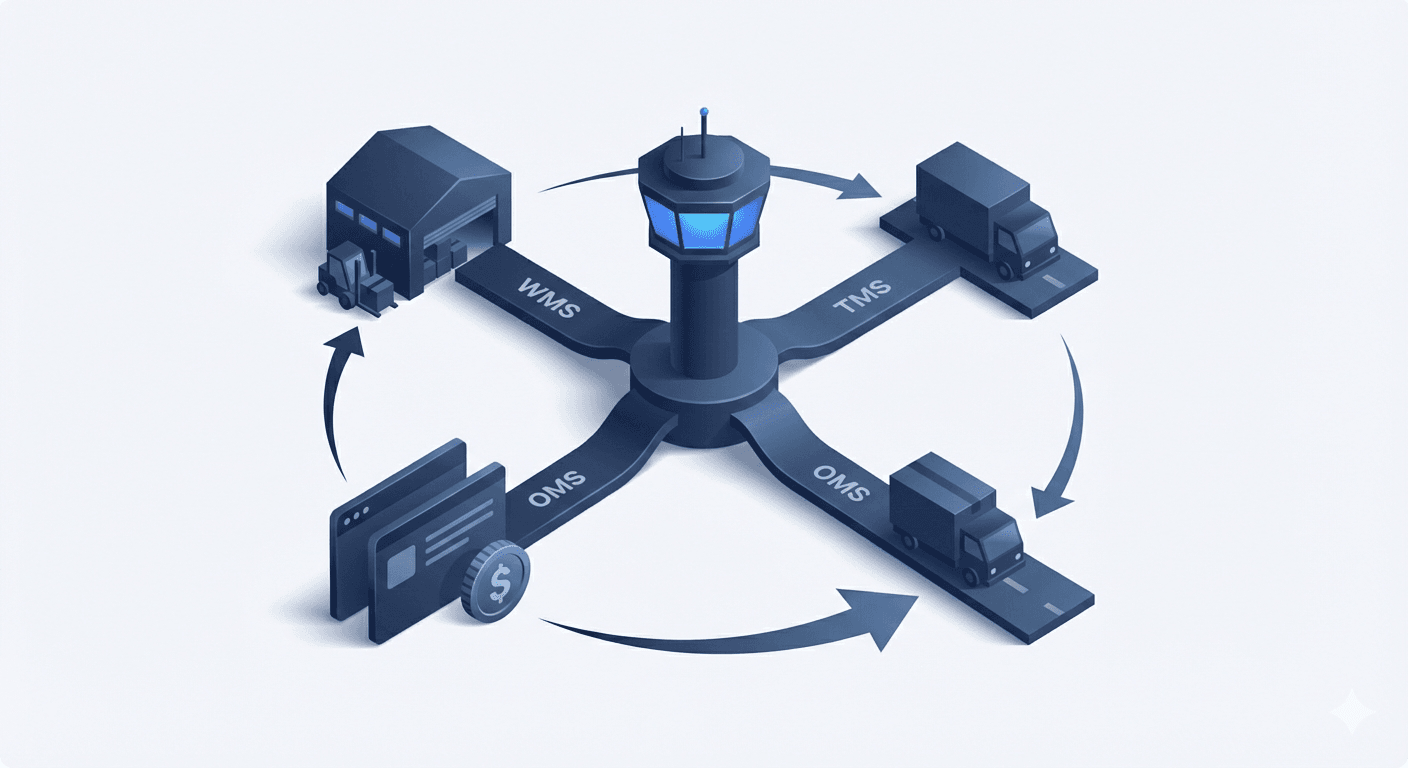

To achieve maximum benefits from a bonded warehouse, businesses need to implement efficient storage management practices. Warehouse Management Software advanced systems enable precise inventory tracking which reduces company errors at the same time. Public bonded warehouses that implement vertical storage solutions and strategic slotting methods achieve enhanced operational efficiency together with financial cost reductions for companies. Organising products for delivery or shipment enables businesses to access items promptly and gain import duty postponement while keeping their supply lines stable.

The Future of Bonded Warehousing

Impact of Technology on Bonded Warehouse Operations

The development paths for bonded warehouses and public bonded warehouses are determined by technological innovations. Operational methods have been transformed through the deployment of autonomous vehicles, robotics, and drones, which have increased workflow precision and operational efficiency. The use of drones facilitates precise pallet scanning which results in reduced inventory management time. Digitalisation improvements in trade emerge from integrating Artificial Intelligence (AI) and the Internet of Things (IoT) technologies with 5G networks which boost customs bonded warehouse efficiency. Businesses benefit from real-time inventory tracking because of the latest technological breakthrough which enables faster and more accurate market-driven inventory adjustments.

Changing Regulations and International Trade Considerations

Bonded warehouses need to continuously update their practices to stay compliant with new customs regulations because import duties and taxes keep evolving. The 2025 Customs (On-Arrival Movement for Storage and Clearance at Authorised Importer Premises) Regulations represent the latest initiative to streamline import clearance procedures. Businesses successfully manage global trade complexities in bonded warehouse operations through adaptable systems combined with strict regulatory compliance.

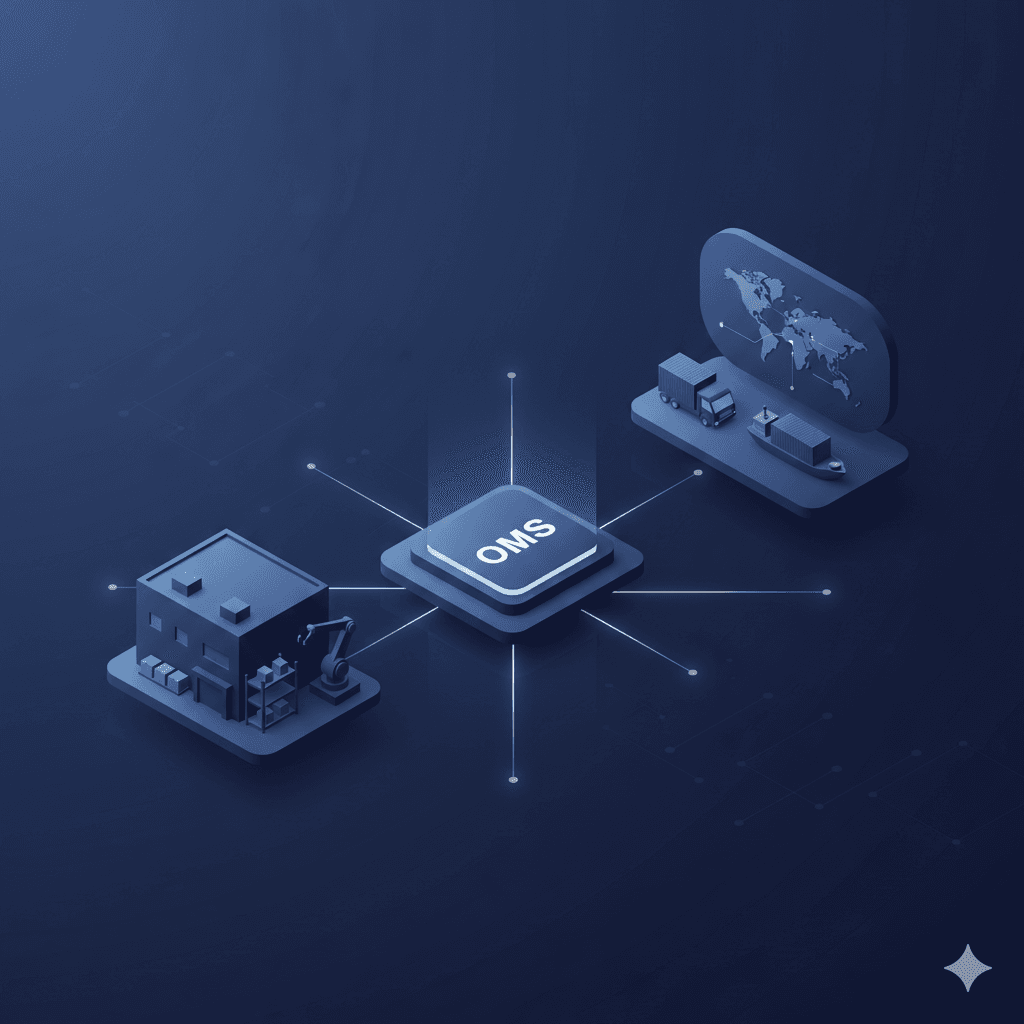

Through bonded storage solutions businesses can postpone payment of import duties and taxes in public bonded warehouses and customs bonded warehouses. Innovative partners such as Omniful help enhance bonded warehouse operations by increasing efficiency while optimising logistics. The strategic integration method promotes effective goods management which leads to optimal financial returns when operating within a bonded warehouse environment.

FAQs

Q: What is a bonded warehouse, and how and why is it used?

A: A bonded warehouse is a safe storage facility where imported products are kept duty-free until exported or released under customs supervision to avoid perpetrating illegalities.

Q: What are the benefits of using a bonded warehouse for my business?

A: A bonded warehouse offers benefits such as payment of customs duty in arrears, improved security, reduced expenses, and accommodative storage that can enhance supply chain efficiency as well as improve cash flow.

Q: What is the difference between a bonded and non-bonded warehouse?

A: The key distinction between a bonded and a non-bonded warehouse is that bonded warehouses permit the postponement of customs duties until the release of goods, whereas non-bonded warehouses demand payment of duty on import.