Mastering E-Invoicing in Saudi Arabia: Best Practices for ZATCA Compliance and Operational Excellence

Table of Contents

Fast Facts for Smart Operators

- E-invoicing is now mandatory under ZATCA regulations in Saudi Arabia.

- Automated invoice submission boosts accuracy and saves hours of manual work.

- Centralised records reduce audit risks and ensure faster tax reconciliation.

- Integration-ready software like Point of Sale systems ensure compliance and scalability.

- Omniful’s Inventory Management System helps track taxable goods in real-time.

Introduction: Why E-Invoicing is More Than a Legal Obligation

In the rapidly evolving landscape of tax regulation, Saudi Arabia has taken bold steps through ZATCA (Zakat, Tax and Customs Authority) to modernise the financial ecosystem. One of the cornerstones of this transformation is e-invoicing, a framework that is no longer optional but essential.

This guide will walk you through the best practices every business must adopt for effective e-invoicing—from maintaining regulatory compliance to using smart tools for automated submissions and secure, centralised records.

Whether you’re a retail chain, logistics player, or a service provider, understanding e-invoicing isn't just about legal box-ticking. It's about streamlining your financial processes and preparing your business for a fully digitised future.

Understanding the ZATCA E-Invoicing Mandate

The ZATCA e-invoicing framework, launched in two phases—Generation and Integration—is applicable to all VAT-registered businesses in Saudi Arabia. Here’s what each phase demands:

Phase One: Generation Phase

Effective since 4 December 2021, this phase required businesses to replace handwritten or PDF invoices with digital, system-generated e-invoices that adhere to a specific XML format.

Phase Two: Integration Phase

Rolling out in stages from January 2023, this phase involves direct integration with ZATCA’s Fatoora portal. Systems must now automatically submit invoices and receive real-time verification responses.

To meet these requirements, companies must deploy ZATCA-compliant invoicing software that enables XML/UBL format generation, tamper-proofing, and secure archiving.

Best Practices for E-Invoicing Compliance in Saudi Arabia

Use ZATCA-Approved Software

Choosing the right solution is your first defence against non-compliance. Look for software solutions that are:

- Fully integrated with ZATCA’s API for real-time submissions

- Capable of generating invoices in structured XML or UBL format

- Equipped with hashing mechanisms to prevent tampering

- Offering local language (Arabic) support as per ZATCA's guidelines

For example, Omniful’s Point of Sale (POS) system integrates directly with ZATCA, streamlining invoice generation and real-time submission.

Centralise Your Invoice Data

Maintain a centralised invoice repository to ensure all transactional data is available from one place. This makes it easier to:

- Retrieve records for audits

- Maintain consistency across multiple business units

- Apply analytics for forecasting and compliance tracking

Consider leveraging Omniful’s Inventory Management System to align sales with taxable stock levels.

Automate Invoice Lifecycle Management

Automation reduces human errors, ensures consistency, and speeds up workflows. Your invoicing platform should support:

- Automated customer validation

- Auto-submission to ZATCA

- Automatic retrieval of acknowledgment responses

- Real-time alerts on errors or compliance issues

These features remove manual bottlenecks and significantly lower your risk profile during audits.

Automating the Submission Process: A Strategic Necessity

Manual uploads to the Fatoora platform are not scalable. For businesses with high volume operations, this approach leads to:

- Frequent data entry errors

- Missed submission deadlines

- Compliance risks due to incorrect formatting

By integrating with APIs provided by ZATCA, businesses can automatically send invoices and receive instant confirmations. This makes the process seamless, fast, and compliant.

With tools like Plug and Play Integrations, businesses can onboard new systems without costly overhauls.

Data Centralisation: The Foundation of Scalable Tax Strategy

When data is siloed across departments, compliance becomes complex and error-prone. Centralising your invoicing and tax records unlocks:

- Better data visibility across departments

- Quicker audit readiness

- Improved cash flow management through invoice tracking

Centralised systems also allow easy reconciliation with sales, inventory, and fulfilment operations, all of which can be managed from Omniful’s Order Management System.

Integrating E-Invoicing with Broader Business Functions

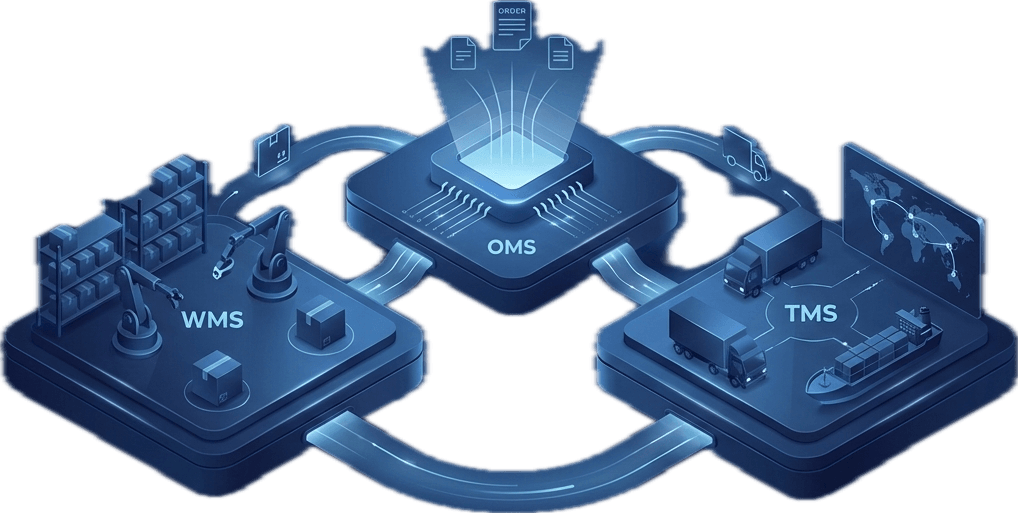

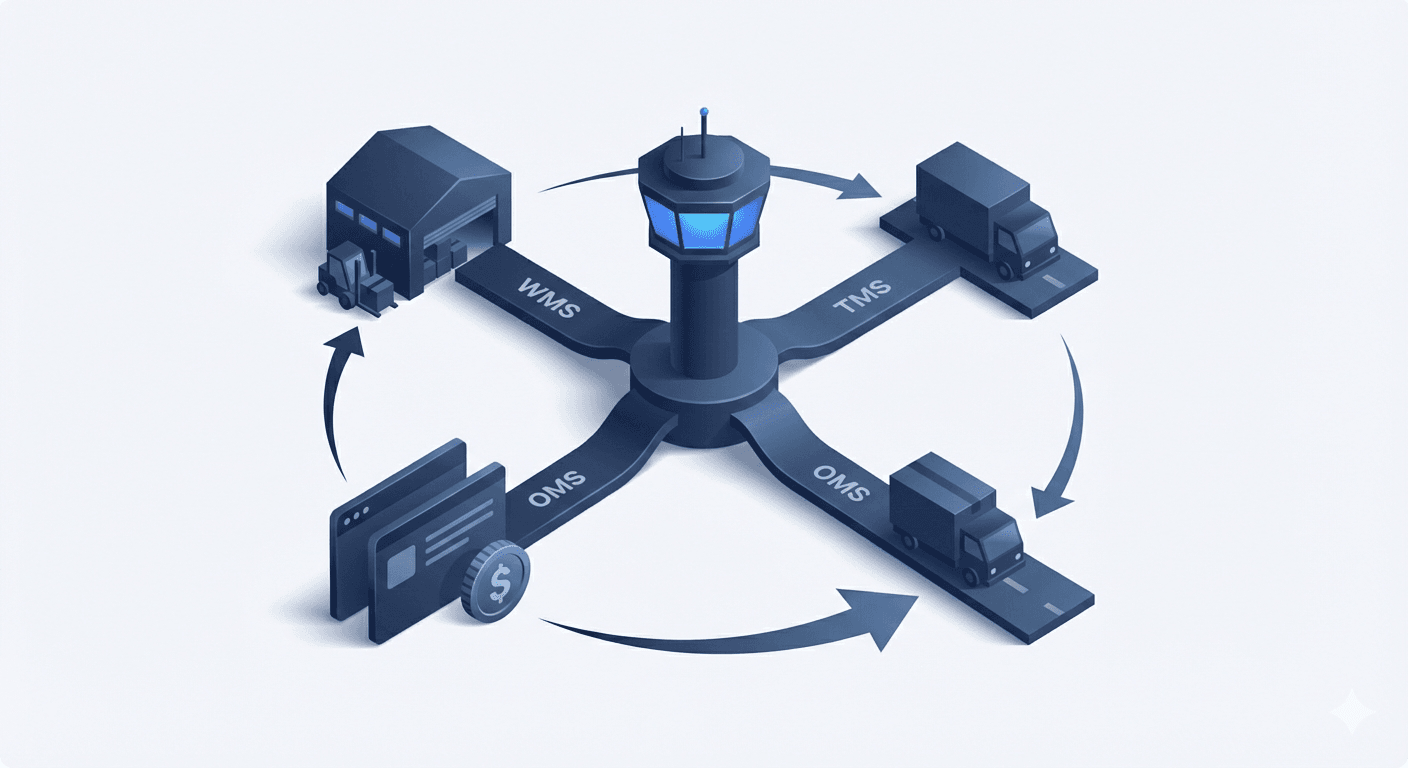

Smart e-invoicing systems don’t operate in a vacuum. For complete effectiveness, they should integrate with:

- ERP and OMS platforms

- Inventory and WMS tools

- TMS and POS terminals

For instance, integrating e-invoicing with your Transportation Management System helps reconcile delivery and payment details in real time, reducing invoice disputes.

Furthermore, integration with systems like Returns Management ensures accurate financial adjustments when refunds or replacements are issued.

Handling Exceptions: Best Practices for Troubleshooting E-Invoices

Even the most automated systems can face exceptions. Create an exception-handling workflow that includes:

- Real-time error reporting from ZATCA’s validation service

- User-defined rules for invoice rejection and re-submission

- Automatic escalation protocols to finance teams

Maintaining an internal log for these events helps in ongoing training, system improvements, and readiness for inspections.

Measuring E-Invoicing Success: What to Track?

To understand the efficiency and ROI of your e-invoicing framework, monitor:

- Invoice submission success rates

- Time taken from sale to invoice delivery

- Audit readiness score (retrievability, formatting, approvals)

- Discrepancy rate between POS and accounting software

- Data synchronisation efficiency across platforms

With Omniful’s Real-Time Dashboards, you can track these KPIs and more.

Building a Future-Proof E-Invoicing Ecosystem

E-invoicing is not a static compliance requirement; it's a foundational shift towards data-driven, transparent, and agile financial operations.

To future-proof your business:

- Review your compliance stack quarterly to match ZATCA updates

- Invest in platforms with AI-readiness for predictive compliance alerts

- Train teams continuously on new features and security practices

Omniful's evolving suite of logistics, retail, and tax compliance tools ensures that businesses in the MENA region remain not only compliant but also competitive.

Frequently Asked Questions

Is ZATCA e-invoicing mandatory for all businesses?

Yes. All VAT-registered businesses in Saudi Arabia must comply with e-invoicing.

How do I know if my system is ZATCA compliant?

Ensure your software is approved by ZATCA and can generate XML-formatted invoices with anti-tampering features.

Can I still use my current accounting software like Focus?

You may, but it must integrate with ZATCA-compliant systems or offer native e-invoicing features.

How often should I update my invoicing solution?

Review and update quarterly, especially when ZATCA announces regulatory changes.

What happens if I fail to comply?

Non-compliance can lead to fines, business suspension, and legal repercussions under Saudi tax law.

See Omniful in Action

Is your business struggling with ZATCA compliance or invoice automation? Experience how our integrated platforms—from POS to Inventory Management—can transform your tax operations and scale your compliance efforts.

👉 Request a Demo to future-proof your tax workflows today.