ERP for Better Tax Compliance: Automating Tax Calculations and Financial Audits

Table of Contents

Instant Insights: Quick-Take Highlights for Decision-Makers

- Automating tax compliance reduces manual errors and boosts accuracy.

- ERP systems offer real-time VAT reporting for MENA-specific tax laws.

- SAP ERP and other systems streamline audits with accurate master data.

- Professional services gain financial clarity with built-in tax modules.

- Integration with purchase order and inventory data strengthens audit trails.

- Real-time master data management ensures consistent tax processing.

- Automating financial audits helps maintain regulatory confidence.

- Better ERP practices improve ZATCA and regional tax authority compliance.

Why Tax Compliance Demands More Than Spreadsheets

In the MENA region, evolving tax regulations are becoming increasingly complex. From UAE’s VAT regime to Saudi Arabia’s e-invoicing laws enforced by ZATCA, businesses must manage intricate tax requirements. Unfortunately, many still rely on spreadsheets or outdated tools to handle these responsibilities.

Manual processes are no longer sufficient. Businesses need systems that can manage and adapt to tax codes, automate data collection, and ensure timely reporting. This is where ERP systems step in—not just as financial tools, but as comprehensive compliance enablers.

Understanding ERP in the Context of Tax Management

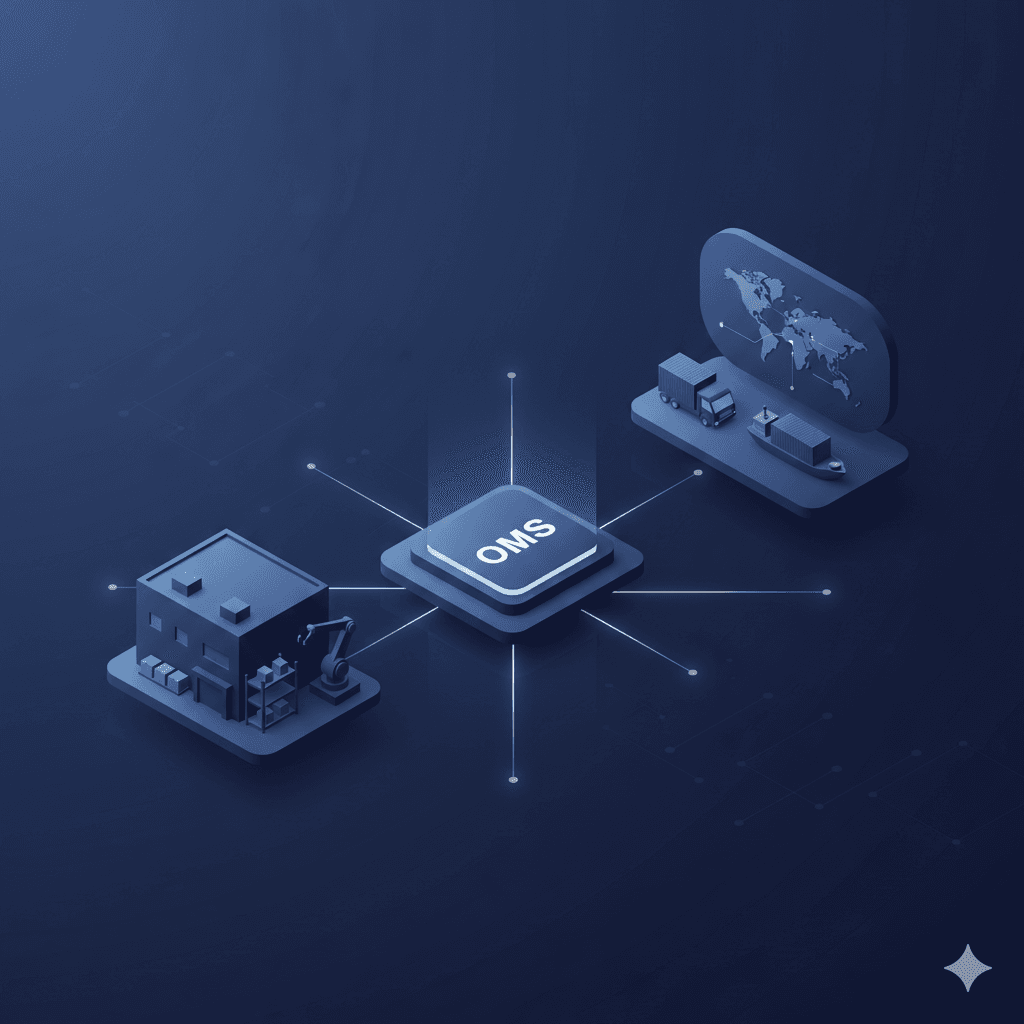

An Enterprise Resource Planning (ERP) system integrates core business processes into a unified platform. In the world of tax, this means bringing finance, inventory, sales, and procurement into one place.

What an ERP Does for Tax Teams:

- Automated Tax Calculations: Apply real-time tax rates on transactions.

- E-Invoicing Compliance: Ensure e-invoices are formatted to regional regulations like ZATCA.

- Financial Audits: Keep clean digital records to simplify audits and reporting.

- Cross-System Accuracy: Centralise data to eliminate discrepancies across platforms.

One of the best-known ERP system examples globally is SAP ERP, which offers industry-specific modules, including advanced tax tools tailored for compliance.

Core ERP Modules That Power Tax Automation

Modern ERP systems are modular. This means you can deploy just what your business needs, and expand as you grow. Here are the most relevant modules for tax and audit automation:

Financial Management Module

At the heart of tax compliance lies finance. This module enables:

- Automatic VAT and GST Calculation

- Real-Time Profit and Loss Statements

- Digital General Ledger Management

- Bank Reconciliation and Tax Provisioning

Procurement Module

The purchase order lifecycle feeds directly into tax liability:

- Automated VAT Allocation per Supplier

- Three-Way Matching for Audit Trails

- Custom Duty Tracking and Local Taxation

Explore how Omniful’s Inventory Management System supports real-time procurement data syncing to ERP platforms.

Sales and Invoicing Module

From B2B to B2C, the ERP’s sales module manages:

- Digital Tax Invoices compliant with e-invoicing mandates

- Real-time Calculation of Tax per SKU

- Tax Category Mapping for Global Products

Master Data Management

Consistency is the unsung hero in compliance:

- One Source of Truth for Tax Codes, Customer Details, and SKU Categories

- Supports multi-entity and multi-region tax settings in the MENA context

For example, Omniful’s Master Catalog Management enables synchronisation of SKUs across all sales channels for accurate taxation.

Benefits of Automating Tax Calculations with ERP

Let’s break down the tangible benefits that tax teams and CFOs experience when they shift to ERP-led compliance:

Accuracy Without Manual Intervention

Errors in tax returns are expensive. With ERP, calculations are applied based on real-time data from sales, procurement, and logistics—minimising human errors.

Region-Specific Compliance

MENA-specific compliance, such as Saudi Arabia’s ZATCA integration or UAE’s Federal Tax Authority (FTA) mandates, can be embedded into ERP workflows. Look for systems with native localisation features.

Audit Trail Transparency

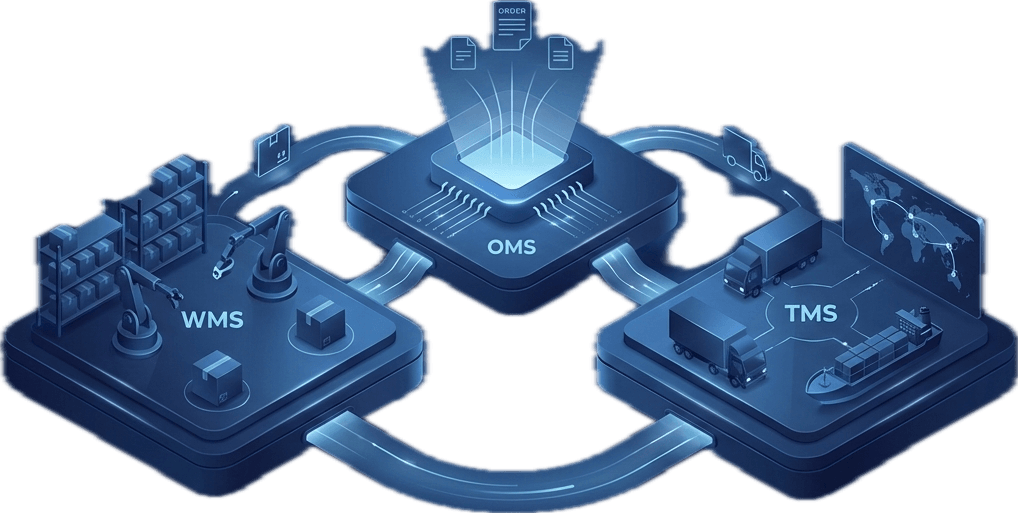

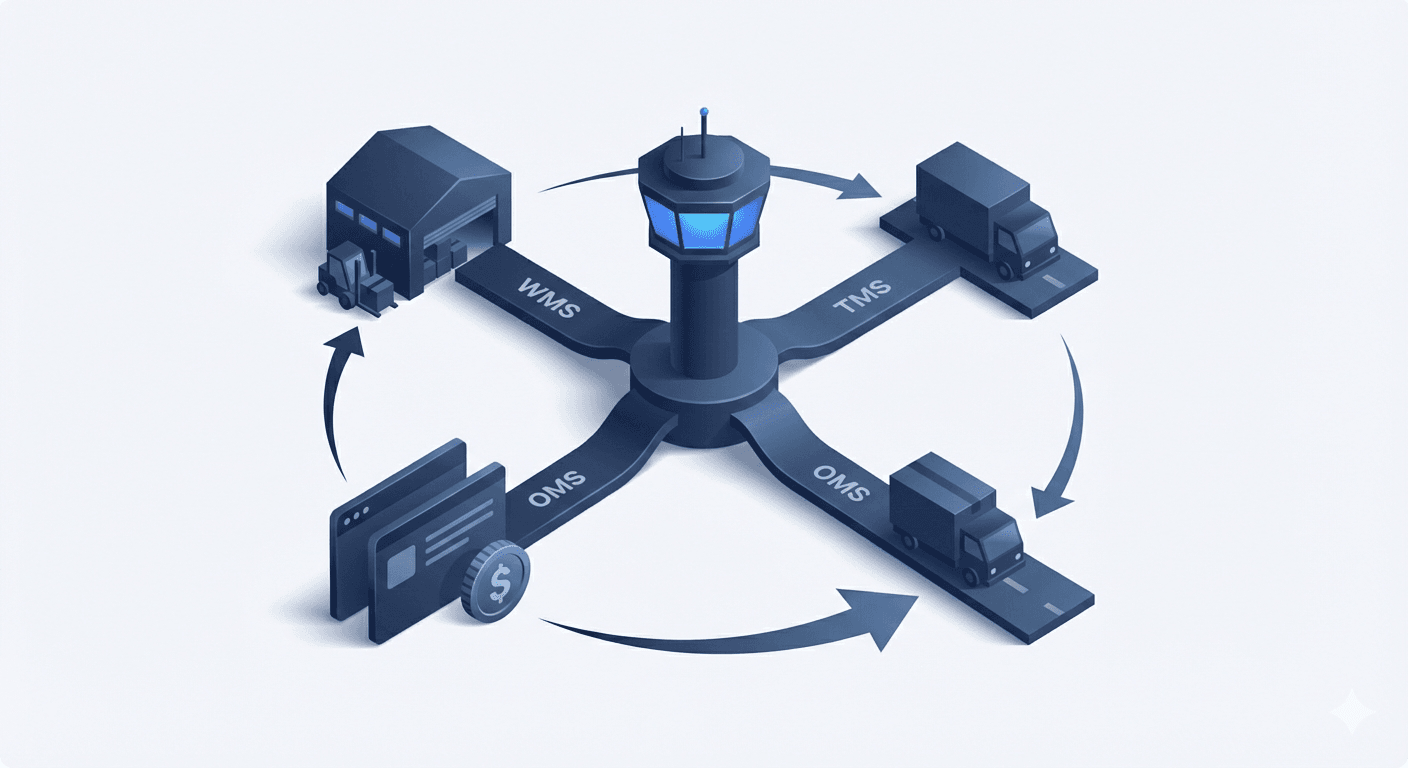

Every transaction is tracked. Whether it's a purchase order raised in the Order Management System or an inventory transfer in WMS, ERP logs the data.

Seamless Updates for New Regulations

When tax laws evolve, the ERP provider updates the tax engine. No need for manual Excel sheet overhauls or emergency IT interventions.

ERP System Examples for Tax Compliance

Several ERP systems are designed with strong tax compliance capabilities. Here are a few widely used examples:

- SAP ERP: Offers regional tax localisation, especially effective for Saudi and UAE compliance.

- Oracle NetSuite: Cloud-native with embedded global tax modules.

- Microsoft Dynamics 365: Favoured by mid-size MENA businesses for flexibility.

Omniful integrates seamlessly with these systems through Plug and Play Integrations, ensuring ERP modules interact with your sales channels, fulfilment systems, and transport layers.

ERP for Professional Services Firms

Professional service firms face unique tax challenges: billable hours, inter-company billing, and often complex multi-currency invoicing.

ERP simplifies this by:

- Categorising services by tax brackets.

- Ensuring compliant invoicing for time-based billing.

- Managing international VAT or GST where cross-border services apply.

ERP modules also help track costs linked to services delivered—providing insights into profitability and tax exposure simultaneously.

Reducing Audit Risks Through Real-Time ERP Analytics

Audit preparedness is no longer a year-end affair. With ERP, companies can:

- View daily reconciliation reports.

- Set alerts for anomalies in tax inputs/outputs.

- Provide external auditors with secure read-only dashboards.

Omniful’s Analytics & Business Intelligence layer supports real-time dashboards and alerts, helping organisations act before small issues escalate into non-compliance.

Localisation and Tax Configuration in MENA ERPs

Regulatory nuances vary:

- Saudi Arabia: ZATCA-compliant e-invoicing is mandatory.

- UAE: Requires real-time VAT submissions to FTA portals.

- Egypt: Implements e-receipt systems and centralised reporting.

ERP systems adapted to these markets must support:

- Local currency-based calculations.

- Language and script localisation (Arabic RTL support).

- Role-based permissions aligned with regional audit standards.

Making the Switch: Things to Consider

Before investing in ERP for tax compliance, ask:

- Does it support ZATCA e-invoicing out-of-the-box?

- Can it handle VAT reconciliation with customs and import data?

- Is the ERP modular, allowing gradual roll-out?

- How does it integrate with logistics and fulfilment platforms?

Also, verify that your ERP syncs with solutions like:

Together, these systems form a digital chain of custody—a key requirement for audits and compliance.

Final Thoughts: ERP is the New Tax Officer

In a digitally regulated economy, your ERP isn't just a tool—it’s your tax officer, your audit assistant, and your compliance guide. With the right configuration, you can reduce the cost of compliance, improve accuracy, and free up your finance team for strategic tasks.

The role of ERP in financial clarity is no longer optional—it’s transformational.

Frequently Asked Questions

What is the role of ERP in tax compliance?

ERP automates tax calculations, manages e-invoices, and streamlines data for audits.

Which ERP systems are suitable for MENA tax laws?

SAP ERP, Oracle NetSuite, and Microsoft Dynamics 365 with regional localisation modules.

How does ERP help in financial audits?

ERP systems store and track all financial data, providing a complete audit trail and automated reports.

Can ERP integrate with logistics and shipping systems?

Yes. Tools like Omniful’s WMS, OMS, and TMS can be integrated for full compliance coverage.

Why is master data management important for tax compliance?

It ensures consistency across transactions and modules, reducing the risk of discrepancies and audit flags.