TMS for International E-Commerce: Handle Tariffs, Duties & Docs Smoothly

Table of Contents

Global Shipments – Local Compliance, Seamless Delivery

- International e-commerce requires end-to-end transport visibility.

- TMS platforms simplify tariff, duty, and customs documentation.

- MENA merchants face unique cross-border logistics and VAT challenges.

- A smart TMS system automates shipping declarations and regional duty workflows.

- Failure to comply can result in delays, penalties, or returned goods.

- Seamless documentation builds customer trust and brand credibility globally.

Introduction: Crossing Borders Shouldn’t Cross Your Margins

International e-commerce opens massive growth opportunities — but it also introduces complex logistics layers that many startups overlook.

From customs declarations to import duties, HS codes to regional restrictions, every international order is a paperwork puzzle.

The good news? A transportation management system (TMS) does more than route trucks. It’s now your engine for cross-border compliance and control.

In MENA, where sellers in Riyadh export to Dubai, or merchants in Cairo ship to Jeddah, logistics is a legal and financial tightrope. Getting it wrong can mean delays, returns, or regulatory fines.

Why Tariffs and Duties Matter in International Logistics

Every country has its own rules for goods entering its borders:

- Tariffs: Taxes applied to imported goods based on category and origin.

- Duties: Charges determined by item value, weight, and classification.

- Customs Clearance: Approval that goods meet import standards.

- HS Codes: Harmonised System codes that define product type for taxation.

If these are calculated incorrectly, shipments can be held at customs, returned to sender, or subjected to surprise fees — damaging both profit and customer experience.

Your TMS must be able to predict, process, and document these elements before the truck leaves the warehouse.

Key Challenges for MENA E-Commerce Exporters

1. VAT & Tariff Complexity: Shipping from UAE to Saudi? You’ll deal with GCC VAT agreements, plus country-specific duty percentages.

2. Missing or Misfiled Declarations: Many MENA SMEs still rely on WhatsApp and manual courier bookings — leading to inconsistent customs documentation.

3. Poor Shipment Tracking: Lack of visibility on customs checkpoints creates customer service headaches and refund requests.

4. Language and Regulation Gaps: Documentation must often be bilingual, especially for Saudi Customs or Egypt’s NAFEZA platform.

5. Return Logistics: Returns from outside MENA must re-enter the region — requiring mirrored documentation and duty reversal.

A TMS system like Omniful's solves these problems by integrating customs workflows into your shipment lifecycle.

What a TMS Does for Cross-Border Shipments

A modern transportation management solution isn't just about planning routes — it's about preparing every shipment for successful international transit.

Key Features Include:

-

Tariff Calculation Automation

Pre-calculate fees and taxes based on HS codes, destination, and order value. -

Document Generation

Auto-fill customs forms (commercial invoice, packing list, declaration forms). -

Multi-Country Carrier Integration

Choose the best shipping partner for compliance in each region (Aramex, DHL, Fetchr). -

Pre-Arrival Clearance Support

Trigger clearance documents to port/cargo handlers before arrival — reducing hold times. -

Duties and Tax Transparency

Provide customers with full landed cost during checkout. -

Multi-Language, Multi-Currency Compatibility

Localise documents for Arabic-speaking customs agents, and settle freight invoices in SAR, AED, USD, etc.

Example: Shipping from KSA to EU

Here’s how a Riyadh-based merchant shipping to Germany might use a TMS:

- Customer places order online.

- TMS pulls item data, value, HS code from integrated ERP.

- Tariffs and VAT calculated automatically.

- Commercial invoice generated in English & Arabic.

- Air waybill assigned and synced with selected carrier.

- Declaration sent to Frankfurt customs in advance.

- Customer notified of customs clearance progress.

The result? No last-minute emails, no surprise fees, no delayed parcels.

Use Cases from MENA Brands

Case 1: Beauty Retailer in UAE

Previously faced delays at Saudi customs due to incomplete HS codes. Omniful TMS automated code matching and now clears 95% of shipments within 24 hours.

Case 2: Electronics Merchant in Egypt

Struggled with EUR zone VAT transparency. Added tax visibility at checkout using TMS integration. Conversion rate for EU customers rose by 17%.

Case 3: Fashion Startup in Jordan

Built full customs declaration flow in TMS for UK shipments. Reduced return-to-sender rates by 60% and improved CSAT scores.

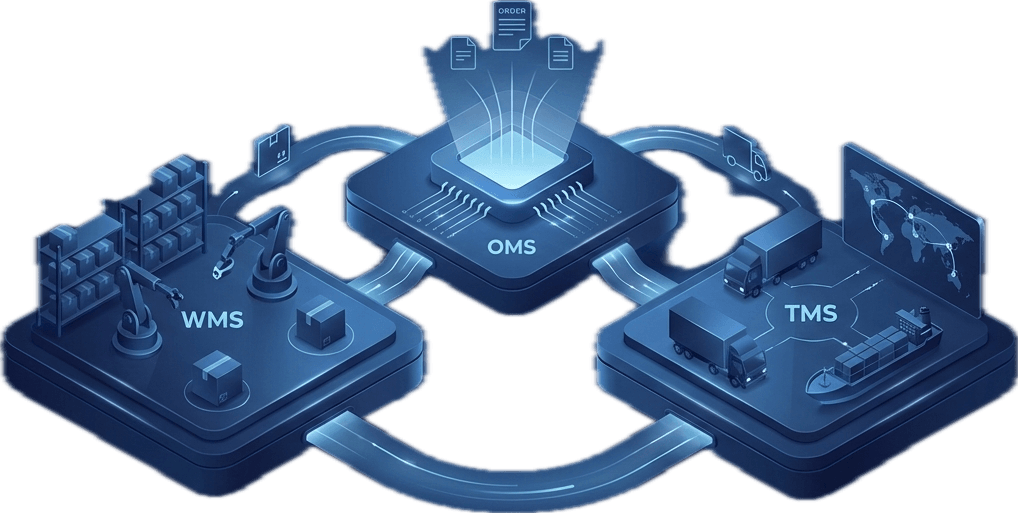

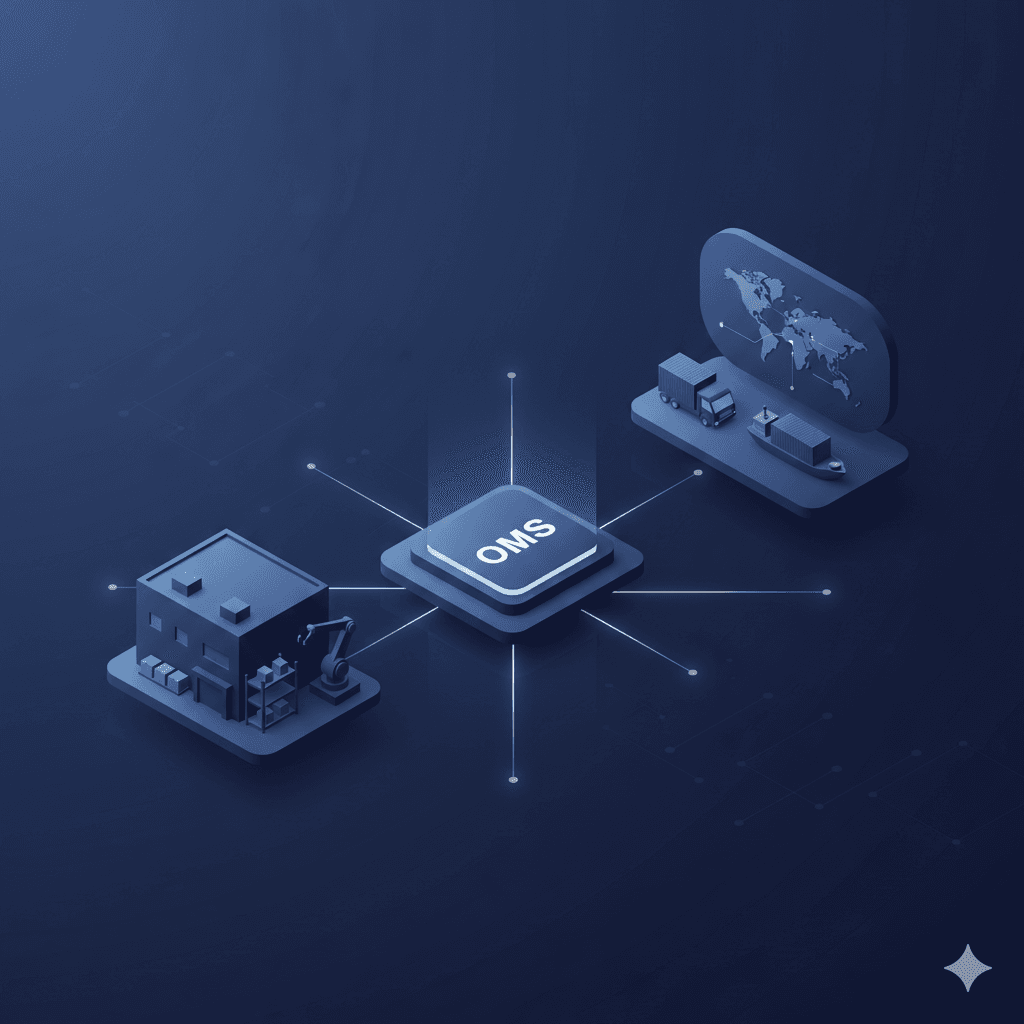

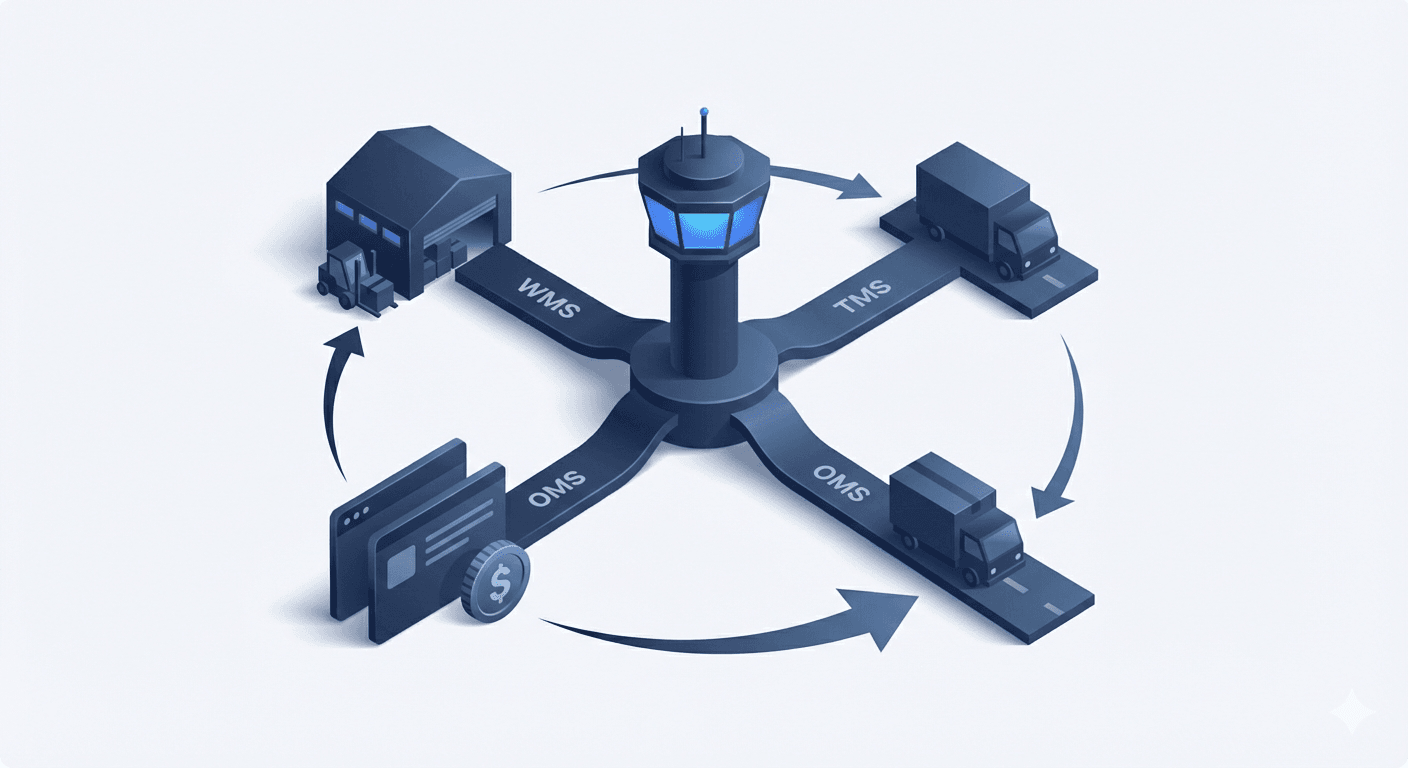

TMS Integration with OMS and ERP

For full international control, your TMS must connect to:

- Your Order Management System for item-level data

- Your Inventory Management System for stock location

- Your shipping providers for AWB and real-time updates

- Your ERP for financial reconciliation and tax reporting

When all systems speak to each other, customs paperwork becomes a workflow — not a bottleneck.

FAQs: TMS for International E-Commerce

What happens if duties are underpaid?

Shipments may be held or rejected by customs. A TMS prevents this by pre-validating tariffs.

Can TMS calculate total landed cost (TLC)?

Yes — Omniful supports TLC display by pulling shipping, tax, and duty data into your checkout experience.

Is this only for large businesses?

No — even startups sending 5 international orders per day benefit from automated documentation and tax handling.

Can I offer DDP (Delivered Duty Paid)?

Yes. With proper TMS rules, you can choose between DDP and DAP shipping models per region.

Global Growth Starts With Local Compliance

Cross-border commerce isn’t just about distance — it’s about documentation.

A smart TMS system makes international shipping feel as predictable as local delivery. No hidden costs. No blocked shipments. No unhappy customers.

If you're scaling across MENA and beyond, it's time to treat tariffs, duties, and customs as digital assets — not obstacles.