AOV & Cart Conversion Analytics in OMS: Unlocking Retail Revenue in GCC for 2026

Table of Contents

Quick Commerce Clarity

- Gain real-time insight into Average Order Value (AOV) and cart conversion rates through OMS analytics.

- AOV helps retailers measure revenue per customer and detect up-sell/cross-sell opportunities.

- Conversion tracking identifies where and why shoppers abandon their carts.

- Supply chain management benefits from OMS data by aligning operations with demand patterns.

- In the MENA region, these metrics are vital for e-commerce success, especially in high-growth sectors like quick commerce.

- Using order management software (OMS), businesses can forecast trends, reduce cart abandonment, and maximise fulfilment accuracy.

The New Benchmark in Supply Chain Optimisation

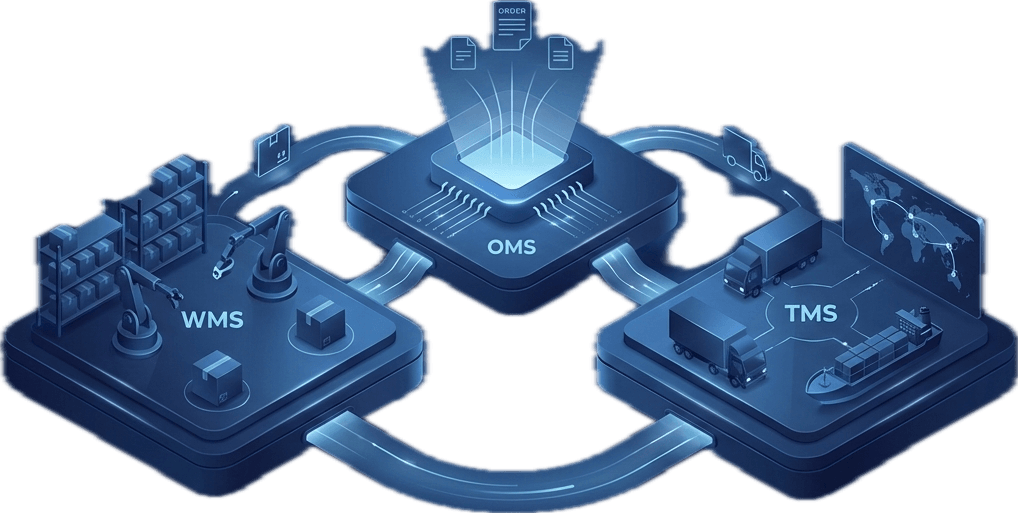

In the current era of hyper-digitisation, retailers across MENA are no longer just managing transactions — they’re managing intelligence. With the rise of omnichannel retail and quick commerce models in Saudi Arabia, the UAE, and Egypt, analytics have become the cornerstone of strategic decision-making.

Order Management Systems (OMS), when paired with advanced analytics, unlock critical metrics such as Average Order Value (AOV) and cart conversion rates — two key indicators that drive not just revenue growth, but operational precision in supply chain management.

Understanding the Core: What Is AOV and Why Does It Matter?

Average Order Value (AOV) is a simple yet powerful metric: it tells you how much a customer spends on average during a single transaction. It’s calculated as:

AOV = Total Revenue ÷ Number of Orders

In a supply chain context, AOV isn’t just a marketing metric. It informs procurement cycles, inventory planning, and even logistics decisions.

Let’s take a practical MENA-specific example: a D2C brand in Riyadh sees a consistent AOV of SAR 300. If a promotional campaign nudges this up to SAR 370, warehouse replenishment models, delivery routing, and even cash-on-delivery thresholds may need realignment.

Cart Conversion Rate: Turning Browsers into Buyers

Cart conversion rate measures how many shoppers who add items to their cart actually complete the purchase. The formula is:

Conversion Rate = (Completed Orders ÷ Carts Created) × 100

This metric is particularly useful in understanding customer behaviour within OMS platforms. More importantly, it identifies where in the funnel customers are dropping off and why.

In the GCC region, for instance, high cart abandonment often relates to unclear shipping costs or lack of real-time inventory visibility. OMS platforms that integrate pricing logic, inventory levels, and fulfilment timelines in real time reduce this uncertainty — and increase conversions.

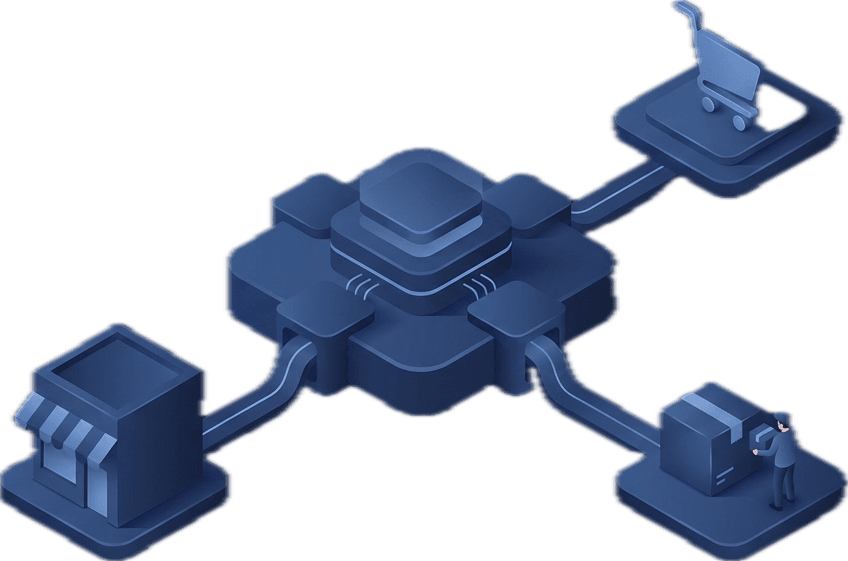

Why OMS Analytics Are Revolutionising Retail in MENA

Traditional ERPs and legacy systems offer fragmented data. Order Management Software (OMS), however, acts as the central nervous system across:

- E-commerce platforms

- POS systems

- Fulfilment centres

- Shipping gateways

- Inventory control systems

In the MENA region, where fragmented infrastructure often leads to inefficiencies, OMS analytics offer unified insights.

Key benefits for retailers include:

- Real-time AOV monitoring for promotional impact.

- Conversion optimisation using behavioural insights.

- SKU-level data for bundling and up-selling strategies.

- Geo-segmented reporting to personalise offers by city or region.

The Link Between AOV and Inventory Strategy

Higher AOV typically correlates with either:

- Upselling and bundling

- High-ticket products

- Increased cart size through free-shipping incentives

From a supply chain management perspective, these behaviours directly affect inventory dynamics. Let’s explore this in a regional setting.

A cosmetics e-commerce platform in Dubai runs a “Spend AED 250, get free express delivery” campaign. The OMS identifies a surge in AOV, prompting the warehouse to optimise bin locations for bundled SKUs and allocate additional last-mile delivery capacity in high-demand zones.

Without OMS analytics, such dynamic inventory strategies would be near impossible.

Conversion Trends That Matter

Modern OMS platforms don’t just report on conversion rates. They analyse trends.

Here are three actionable conversion insights drawn from leading OMS analytics:

Abandonment by Payment Method

In many MENA markets, customers still prefer cash-on-delivery (COD). If a platform sees lower conversions for online payments, it may reflect trust issues. Retailers can then introduce hybrid models like “COD with deposit” or integrate local fintech for BNPL (Buy Now, Pay Later) solutions.

Product-Level Drop-Offs

If a particular SKU sees frequent cart additions but low conversions, the issue may be:

- Poor product imagery

- Inadequate description

- Lack of stock

- Price competitiveness

OMS analytics pinpoint these anomalies in real time.

Time-of-Day Impact

Conversion rates fluctuate depending on when users shop. In Saudi Arabia and the UAE, peak hours often align with post-work evenings and late-night scroll sessions. Retailers using OMS analytics can schedule flash sales accordingly.

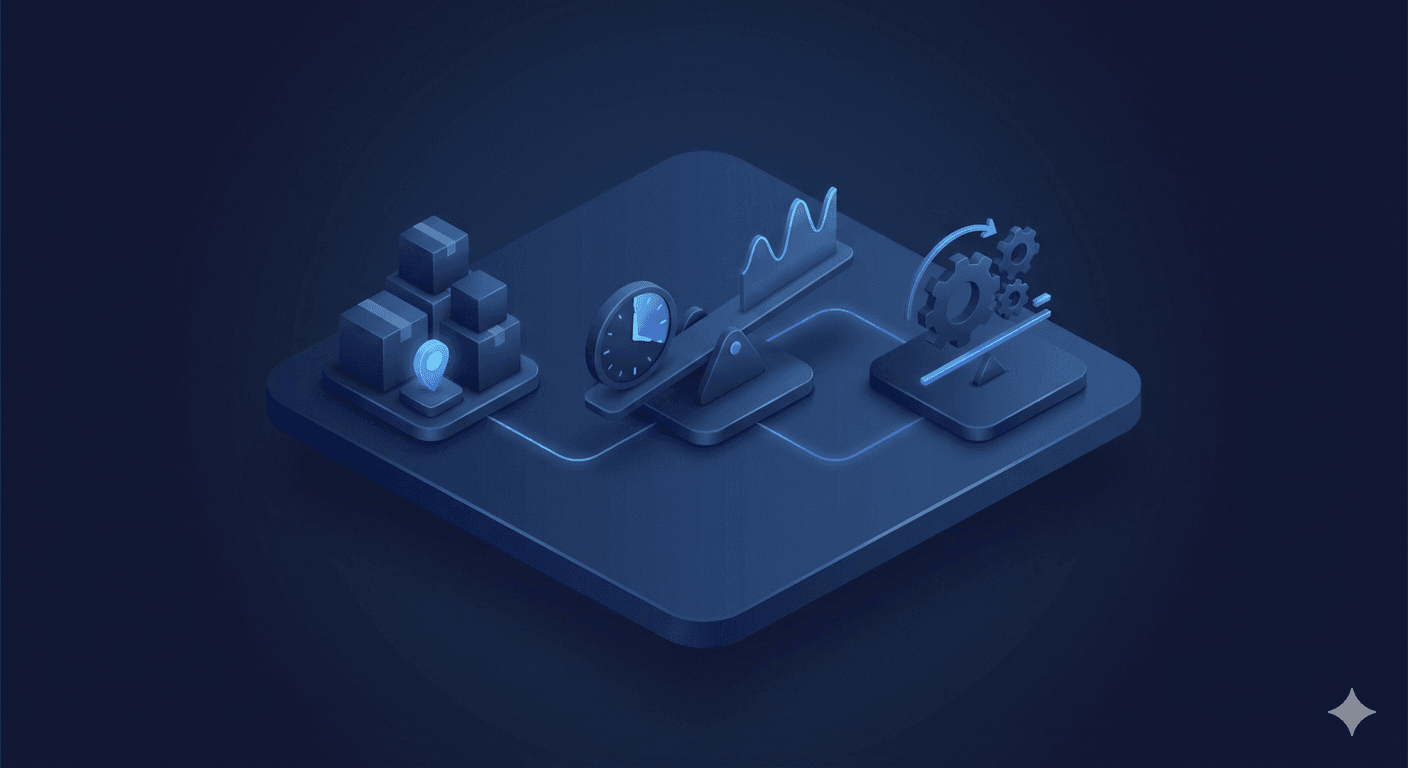

AOV and Conversion Analytics in Fulfilment Planning

Here’s where order management software becomes a game-changer for supply chain logistics.

When AOV increases, so does the order weight and complexity. OMS analytics can then:

- Adjust bin-packing algorithms in WMS modules.

- Notify carriers for bulk shipment readiness.

- Predict zone-based delivery delays or rerouting needs.

For businesses operating in markets like Egypt or KSA with regional warehousing strategies, this data enables fulfilment managers to stage inventory in the right hubs, cutting down delivery times and costs.

Regional Challenges & OMS Adaptation in MENA

MENA’s unique landscape — characterised by high COD reliance, multiple languages, and varied logistics infrastructure — demands adaptive OMS analytics.

Key regional adaptations include:

- Arabic-first dashboards for operational teams

- Real-time sync across dark stores, retail POS, and e-commerce

- Hyperlocal delivery insights, especially in dense cities like Cairo and Riyadh

- Support for local carriers like Aramex, Jahez, and Naqel through OMS-integrated shipping gateways

Omniful, for instance, offers such customisation, enabling retailers to track AOV and conversions per region, per store, or even per fulfilment route.

Integrating OMS Data with Sales and Marketing

One overlooked benefit of using OMS analytics for AOV and conversion is how it feeds sales and marketing intelligence.

- Performance-based pricing: Tailor offers based on high-converting items.

- Loyalty programmes: Segment by AOV and offer exclusive perks.

- Campaign tracking: Monitor which digital ads increase conversions, not just clicks.

In practice, a retailer using Omniful’s OMS may launch an Instagram campaign targeting Gulf-based users, monitor real-time conversion shifts via the dashboard, and adjust stock replenishment mid-campaign.

Predictive Analytics: The Future of OMS Insights

OMS platforms are increasingly moving from reactive dashboards to predictive intelligence.

Using AI and machine learning, businesses can forecast:

- Future AOV trends based on seasonality (e.g., Ramadan, back-to-school)

- Cart conversion shifts during new product launches

- Return rates that may offset actual revenue gains from higher AOV

This enables a truly proactive supply chain model — where fulfilment, warehousing, and marketing are all aligned with data-driven predictions.

MENA Case Study: From Metrics to Mastery

Client: Laverne – A fragrance conglomerate managing 8 D2C brands in Saudi Arabia

Challenge: Inconsistent fulfilment with external 3PLs led to poor AOV growth

Solution: Adopted in-house OMS with real-time analytics

Result:

- Order-to-delivery time dropped from 4 days to 2 hours

- AOV grew by 18% after launching AI-powered product bundling

- Conversion rate improved due to real-time inventory visibility

Such success stories underscore the power of using OMS analytics to drive business performance, especially in a high-velocity retail environment.

See Omniful in Action

Omniful’s OMS offers real-time analytics dashboards, customisable AOV reporting, and predictive insights that empower retailers across the MENA region.

Whether you're scaling dark stores, improving cross-border fulfilment, or just starting your e-commerce journey, leveraging OMS analytics for AOV and conversion optimisation is no longer optional — it’s essential.

👉 Book a Demo with Omniful

👉 Explore Omniful Features

Frequently Asked Questions (FAQs)

What is considered a good AOV in MENA retail?

It varies by category, but SAR 250–350 is a typical benchmark in sectors like fashion and electronics.

How can I increase my AOV through OMS?

Use features like product bundling, dynamic pricing, and real-time stock recommendations within the OMS.

Does cart abandonment always mean customer dissatisfaction?

Not always — it could reflect indecision, payment friction, or lack of urgency. OMS analytics help decode the ‘why’.

Can I track AOV by sales channel?

Yes, modern OMS platforms allow segmentation by channel, geography, and campaign.

Is it possible to integrate OMS data with third-party marketing tools?

Absolutely. Platforms like Omniful support API-based integrations with CRMs, ERPs, and marketing stacks.