ERP Analytics: Dashboarding for CFOs, COOs — Live Snapshots of Revenue, Costs, and Operations

Table of Contents

Quick Wins for Effective ERP Analytics

- Gain real-time insights into costs, revenue, and operations.

- Use dashboards for faster, data-driven decisions.

- Identify cost-saving opportunities across departments.

- Track key metrics like cash flow, profit margins, and expenses.

- Enhance financial transparency for better strategic planning.

Introduction: Why ERP Analytics is Essential for Financial Leaders

Financial leaders are under constant pressure to improve profitability, control costs, and make strategic decisions that drive business growth. However, these tasks can be challenging without accurate, real-time data. This is where ERP (Enterprise Resource Planning) analytics comes into play.

ERP analytics is a powerful tool that consolidates data from various business processes into a single platform. It provides CFOs and COOs with live snapshots of revenue, costs, and operational performance, enabling them to make data-driven decisions quickly. In this guide, we will explore how ERP dashboards can transform financial management, improve operational efficiency, and enhance overall business performance.

Why CFOs and COOs Need ERP Analytics

ERP analytics is not just about tracking revenue and expenses. It provides a comprehensive view of the entire business, helping financial leaders make smarter decisions. Here’s why it’s essential:

- Real-Time Financial Insights – Access live data on revenue, costs, and cash flow.

- Improved Decision-Making – Make strategic choices based on accurate, up-to-date data.

- Cost Control – Identify inefficiencies and reduce unnecessary expenses.

- Data-Driven Planning – Use historical data for accurate forecasting.

- Operational Transparency – Gain a clear view of every part of the business.

Key Features of ERP Analytics Dashboards

-

Real-Time Financial Data

Real-time data is the foundation of effective financial management. It allows CFOs and COOs to monitor revenue, costs, profit margins, and cash flow without delays. This is critical for making quick, data-driven decisions in fast-paced business environments. -

Customisable KPIs and Metrics

Every business has unique financial goals. ERP dashboards provide the flexibility to customise key performance indicators (KPIs) based on these goals. Common KPIs include gross profit margin, cash flow, operating expenses, and net profit. These metrics give financial leaders a clear picture of business health. -

Advanced Data Visualisation

Data alone isn’t enough. It needs to be presented in a way that is easy to understand. ERP systems like SAP ERP come with powerful data visualisation tools, allowing CFOs to create charts, graphs, and heatmaps that highlight trends, risks, and opportunities. -

Automated Financial Reporting

Manual reporting can be time-consuming and prone to errors. ERP systems automate this process, reducing the risk of mistakes and saving valuable time. Automated reports provide a clear picture of financial performance, helping CFOs and COOs make informed decisions. -

Master Data Management

Consistency is key in financial reporting. ERP systems use master data management (MDM) to ensure data consistency across all departments. This reduces discrepancies and ensures accurate financial reporting, which is crucial for regulatory compliance. -

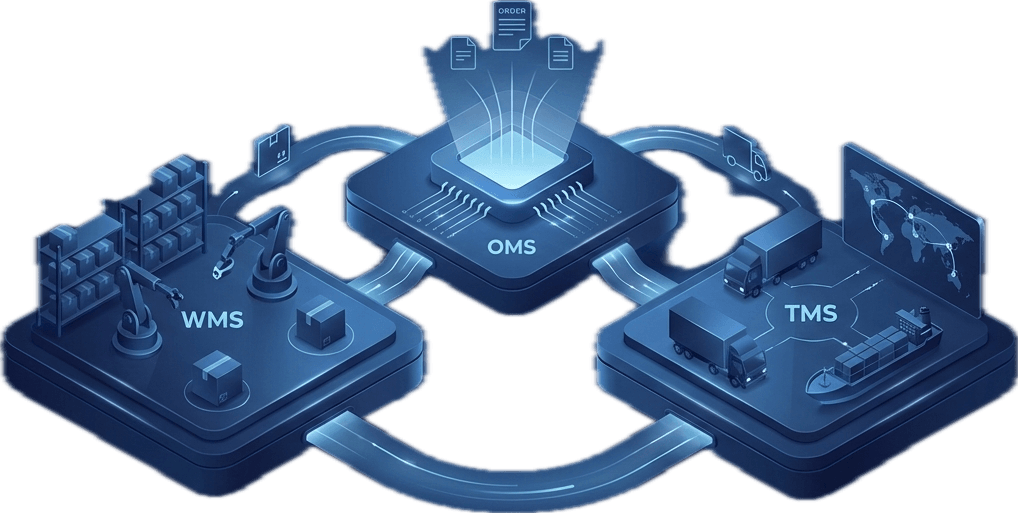

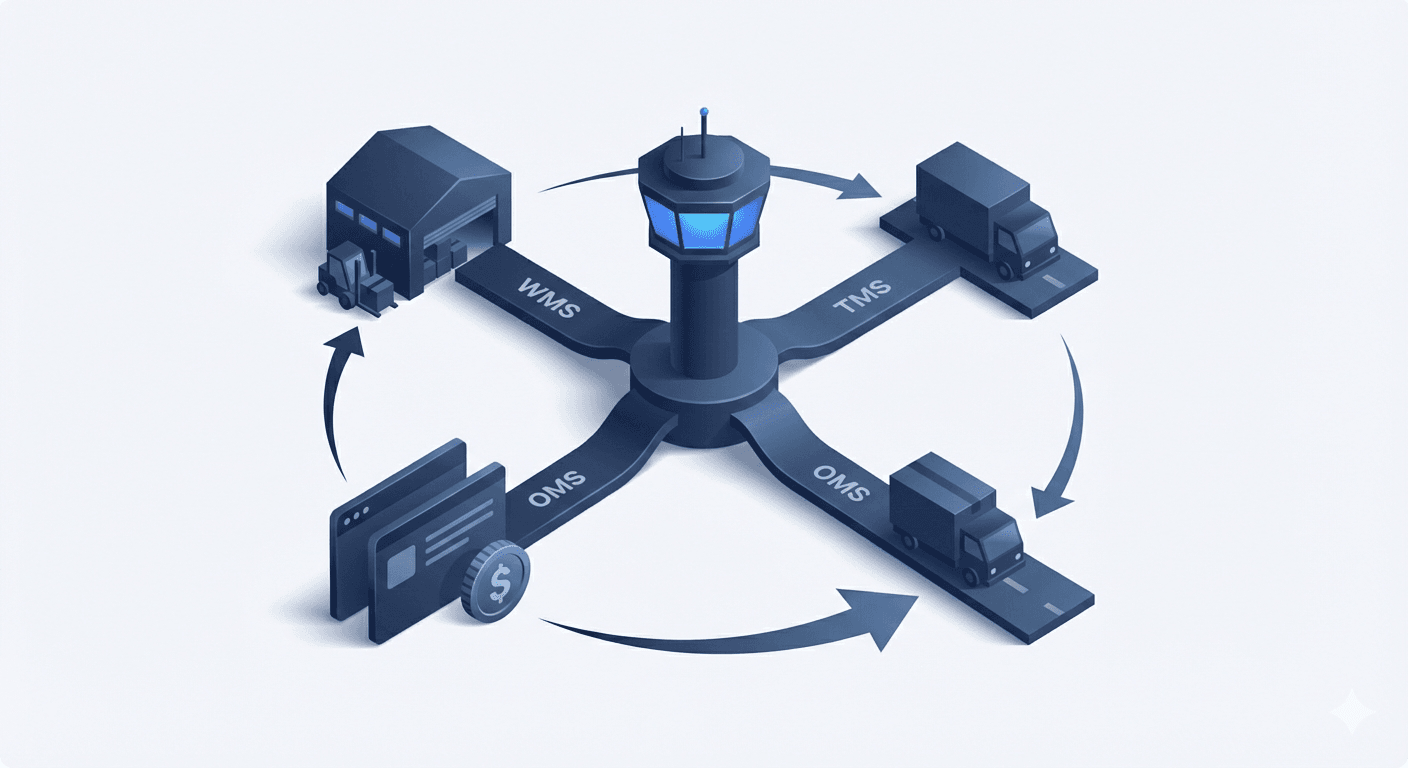

Integration with Other Business Systems

ERP dashboards are not standalone tools. They integrate with other business systems like CRM, inventory management, and HR, providing a complete view of business performance. This integrated approach improves financial accuracy and operational efficiency.

Benefits of ERP Analytics for CFOs and COOs

- Faster Decision-Making – Make quicker, data-driven decisions with real-time insights.

- Improved Cost Control – Identify and eliminate unnecessary expenses.

- Accurate Forecasting – Use historical data to predict future revenue and costs.

- Reduced Financial Risk – Ensure compliance with financial regulations.

- Greater Financial Transparency – Provide stakeholders with accurate, up-to-date financial data.

Best Practices for Effective ERP Dashboarding

- Set Clear Financial Goals

Identify the metrics that matter most to your business. - Use Real-Time Data

Ensure your dashboards are always up-to-date for accurate decision-making. - Automate Routine Reports

Reduce manual errors by automating financial reporting. - Focus on Data Accuracy

Implement master data management to maintain data consistency. - Leverage Visualisation Tools

Use charts and graphs to present complex data clearly.

FAQs About ERP Analytics for CFOs and COOs

-

What is ERP analytics?

ERP analytics is the process of collecting, analysing, and visualising business data within an ERP system to gain insights into financial performance. -

How can ERP dashboards improve financial decision-making?

They provide real-time insights into costs, revenue, and operational efficiency, enabling data-driven decisions. -

What is master data management in ERP?

Master data management (MDM) ensures consistency and accuracy of critical business data across departments. -

Can ERP dashboards reduce operational costs?

Yes, they help identify inefficiencies and cost-saving opportunities. -

What are some popular ERP system examples?

Popular ERP systems include SAP ERP, Oracle NetSuite, Microsoft Dynamics 365, and Infor CloudSuite.