ERP Auto-Reconciliation: How Smart Matching of POs, Invoices and Shipping Documents Speeds Up Accounting

Table of Contents

Fast-Track Accounting: Summary Snapshots for Quick Grasp

- Automating document matching reduces accounting delays and human error

- ERP auto-reconciliation integrates with procurement and logistics modules

- Instant matching of purchase orders (POs), shipping notes and invoices

- Strengthens supplier compliance and audit trails

- Cuts time and costs spent on manual financial checks

- Crucial for fast-growing MENA retail and logistics sectors

- Supports Inventory Management and Returns visibility

- Improves control in complex supply chain operations

Introduction: From Bottleneck to Breakthrough in Accounting

Accounting bottlenecks often start in one place—manual reconciliation. Finance teams waste time cross-checking purchase orders, invoices, and delivery documents. This outdated process not only delays month-end close but also increases the risk of errors.

In the modern MENA retail and supply chain ecosystem, businesses operate at a speed that traditional methods can’t match. Here’s where ERP auto-reconciliation becomes a game-changer. It automates the matching process, linking multiple document types across procurement, warehouse and financial systems.

Let’s explore how this automation strengthens your accounting, boosts transparency, and accelerates business decision-making.

The Core Problem: Manual Reconciliation Wastes Time and Resources

Before automation, the financial close process in many companies involved multiple spreadsheets, endless back-and-forth emails, and tedious manual validation.

Here are the usual steps:

- Match PO from procurement with the invoice

- Check delivery notes or Goods Received Notes (GRNs) for proof of fulfilment

- Cross-validate item quantity, price, tax, and shipping terms

Now, imagine doing that for hundreds or thousands of transactions monthly. This leads to:

- Delays in financial closing

- Human errors due to repetitive tasks

- Poor visibility into actual costs and liabilities

- Compliance risks during audits

Manual workflows are not just slow—they’re incompatible with modern ERP systems designed for speed, precision, and scale.

What Is ERP Auto-Reconciliation?

ERP auto-reconciliation is a smart module within an ERP system implementation that automates the process of matching and verifying purchasing, receiving, and invoicing records.

It intelligently matches:

- Purchase Orders (POs) from procurement

- Goods Received Notes (GRNs) or delivery slips from logistics

- Invoices from suppliers

By comparing fields like SKU, quantity, cost, tax, and delivery terms, the system flags discrepancies or approves matches automatically.

How It Works: Automation in Action

Data Integration Across ERP Modules

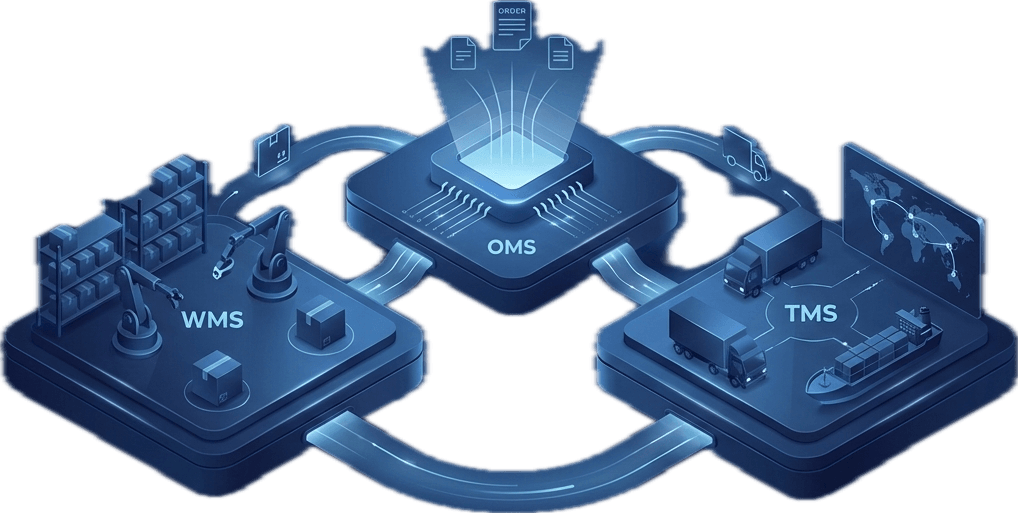

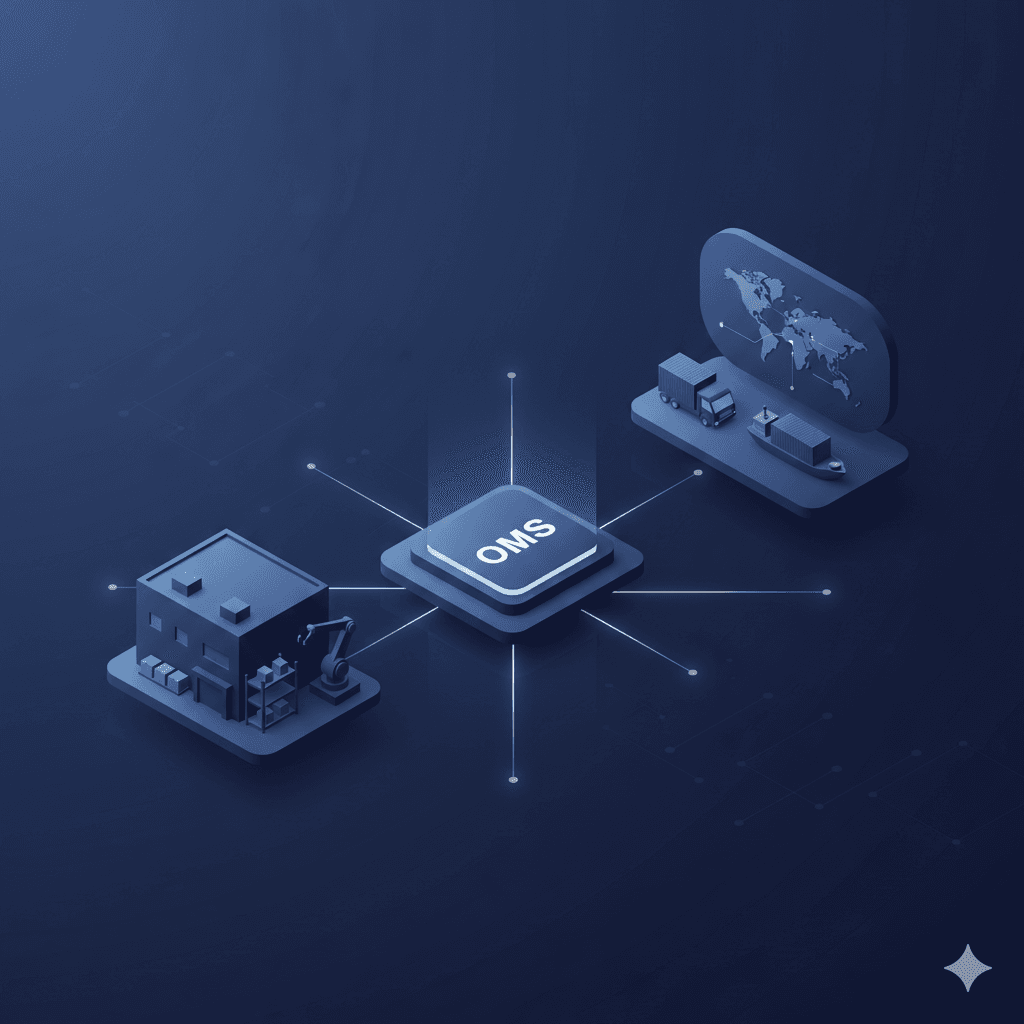

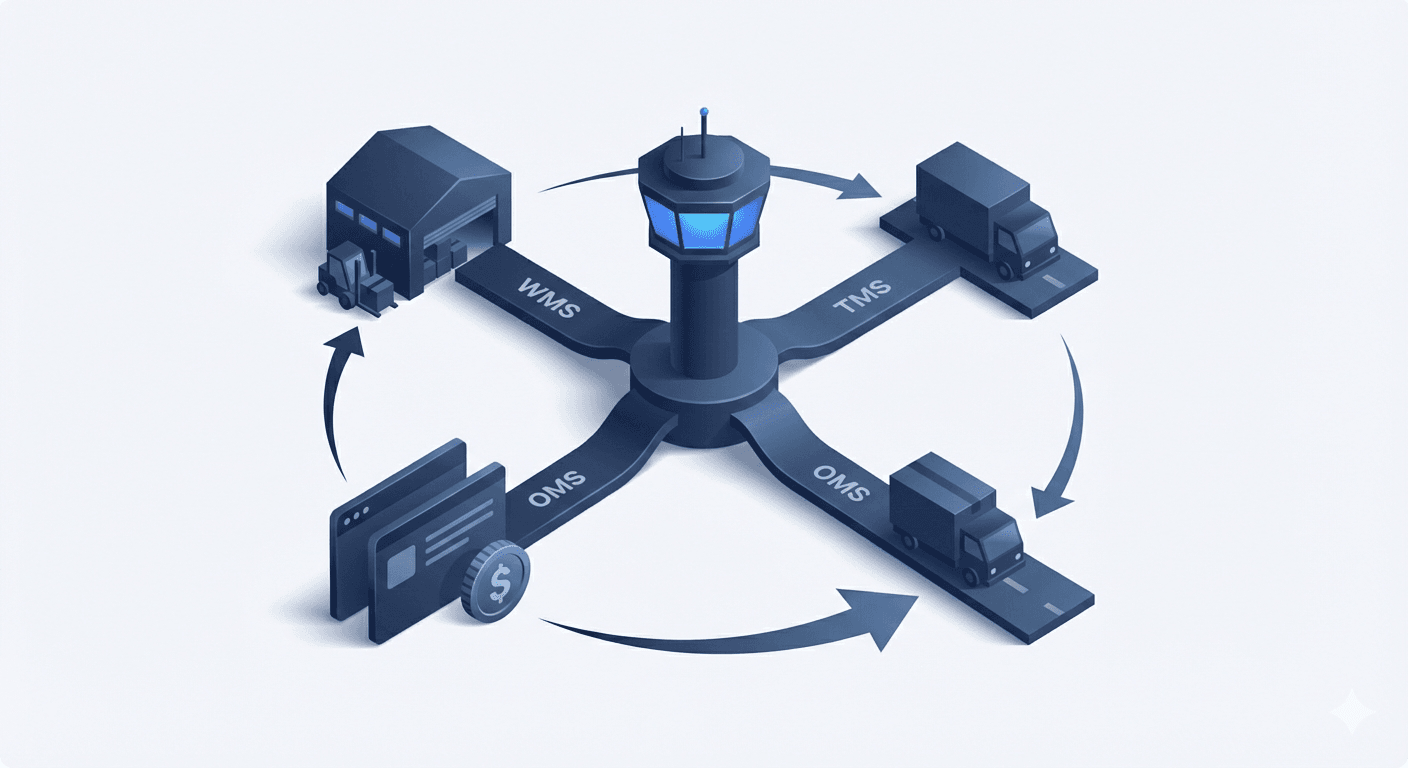

ERP auto-reconciliation sits at the intersection of:

- Procurement Modules – Generates POs

- Warehouse Management Systems – Logs GRNs and delivery details

- Accounting Modules – Processes incoming invoices

Once the PO is raised, any incoming delivery updates or invoices are automatically matched against the original order details.

Smart Matching Algorithms

These use rule-based logic to:

- Validate invoice totals against PO terms

- Match SKU quantities to delivery records

- Identify duplicate invoices or missing GRNs

- Flag mismatches for manual review

Dashboard Alerts and Reports

Finance teams are alerted in real-time of:

- Unmatched transactions

- Discrepancies in price or quantity

- Missing documents or approvals

Real-World Impact: MENA Supply Chain Use Case

Scenario: A Retailer in KSA

A Riyadh-based home appliance retailer deals with over 500 suppliers and 1,200 SKUs. Manual reconciliation cost the finance team over 40 hours a week.

After deploying an auto-reconciliation module via their best ERP system, the team:

- Reduced reconciliation time by 85%

- Closed monthly books 3 days faster

- Flagged 7% of invoices with duplicate or incorrect charges

It improved both operational efficiency and supplier relations—leading to cost savings and faster financial insights.

Benefits of ERP Auto-Reconciliation

Faster Financial Close

Automating the match process shortens the time needed to finalise books. This helps leadership make timely decisions backed by accurate data.

Improved Compliance and Audit Readiness

Audit trails are digitally recorded, eliminating lost documents or unverifiable transactions. This aligns with the increasing compliance needs in UAE and KSA.

Better Cash Flow Management

With accurate invoice verification, businesses can confidently release payments or dispute issues early, improving cash flow visibility.

Stronger Vendor Relationships

Quick and correct invoice processing ensures suppliers are paid on time, fostering trust and negotiation leverage.

Scalable Financial Operations

As transaction volumes grow, automation ensures your accounting can scale without needing to double the finance team.

MENA-Specific Advantages

ERP auto-reconciliation is particularly valuable in the MENA region where trade involves:

- Complex customs documentation

- Multi-currency transactions

- VAT-specific compliance (e.g. ZATCA in Saudi Arabia)

- Cross-border logistics challenges

By reducing friction between procurement, shipping, and accounts payable, this solution helps companies achieve faster inventory turnover, stronger audit controls, and enhanced ROI from their Warehouse and Shipping Gateway systems.

Key Features to Look for in Auto-Reconciliation

Integrated ERP Modules:

Make sure your ERP supports tight integration across:

- Procurement

- Inventory

- Transportation

- Accounting

Real-Time Document Matching:

Instant updates are vital for catching discrepancies before they affect cash flow.

Flexible Matching Rules:

Different suppliers may follow different invoice formats or shipping terms. Your ERP should adapt to these variations.

Exception Management:

Allow flagged mismatches to be reviewed, escalated, or disputed within the system.

Regional Compliance Support:

Ensure the module is compatible with MENA tax and invoice regulations, such as VAT e-invoicing for POS systems in Saudi Arabia.

Seamless Integration: A Must-Have

ERP auto-reconciliation should not exist in isolation. It should plug directly into:

- Inventory Management Systems for stock verification

- Order Management Systems for fulfilment records

- Returns Management for handling reverse logistics

This creates a unified system of truth, cutting down duplication and improving trust in the data.

Challenges & How to Overcome Them

Data Standardisation: Legacy documents and unstructured data make matching hard. Use AI-powered OCR tools to extract consistent data formats.

Supplier Resistance: Some suppliers may resist digital invoicing. Onboard them using supplier portals or EDI integration.

Overdependence on Automation: Keep a human review process for flagged exceptions. Balance automation with judgement.

FAQs on ERP Auto-Reconciliation

What is the biggest time-saving benefit?

Faster invoice approvals and shorter financial close cycles.

Can it handle multiple currencies and tax rules?

Yes. Good ERP systems are designed to support VAT compliance and multi-currency reporting.

Is ERP auto-reconciliation suitable for SMEs?

Absolutely. With modular ERPs, even mid-sized firms can benefit without heavy infrastructure costs.

How long does implementation take?

Anywhere from 2 to 8 weeks depending on complexity and existing ERP structure.

Final Thoughts: Your Next Step in Financial Automation

ERP auto-reconciliation is not just a ‘nice-to-have’. For fast-moving MENA enterprises, it’s essential. From procurement to fulfilment to accounting, this automation strengthens every financial touchpoint.

Whether you're scaling dark stores in Riyadh, streamlining 3PL billing in Dubai, or managing cross-border eCommerce orders, ERP auto-reconciliation lets you grow without losing financial control.

Want to see how Omniful can transform your reconciliation process? Request a Demo today.