ERP for Finance & Purchasing: Streamlining Budgets, Orders, and Vendor Collaboration

Table of Contents

Why the MENA Region Needs Smarter Spending Systems Today

In a region where retail chains, distribution hubs, and logistics providers are expanding rapidly, one thing is clear—manual procurement and financial workflows cannot keep up. Businesses operating across the UAE, Saudi Arabia, and Egypt are facing tighter budgets, more vendors, and rising supply chain complexity.

To survive and thrive, companies need tools that help track, control, and optimise every transaction—without slowing down.

Enter the ERP system.

Specifically built for finance and purchasing, today’s ERP solutions allow teams to generate automated purchase orders, manage department budgets, and collaborate efficiently via vendor portals—all while ensuring accountability and accuracy.

Quick Bytes for Busy Minds

- ERP systems help automate purchase orders and financial controls

- Real-time budget tracking ensures spend doesn’t exceed limits

- Vendors access secure portals to manage invoices and deliveries

- Omniful’s Plug & Play Integrations ensure smooth ERP connectivity

- User-specific ERP login protects access and builds accountability

- MENA companies gain better compliance, cash flow, and speed

Understanding ERP: erp system معنى for Decision Makers

Many business leaders in the Arabic-speaking world search for “erp system معنى.” Simply put:

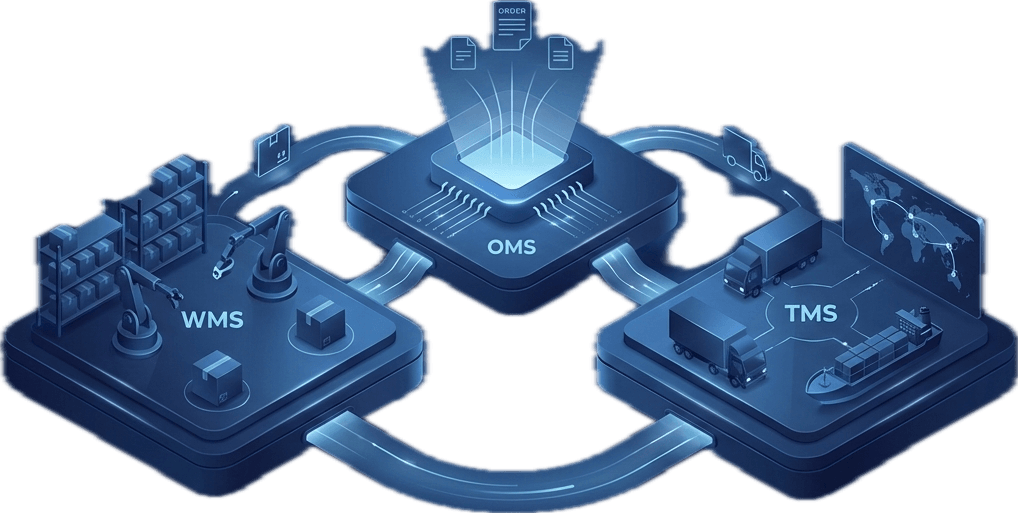

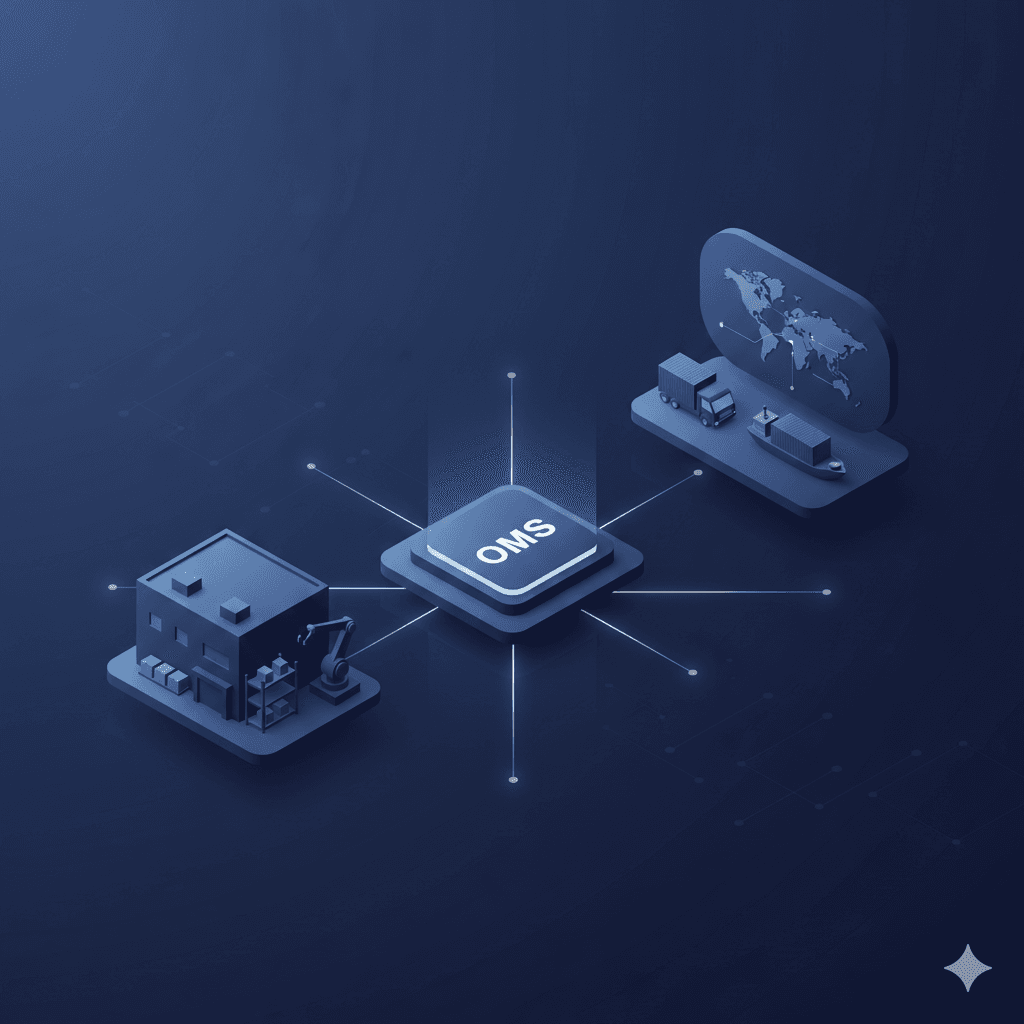

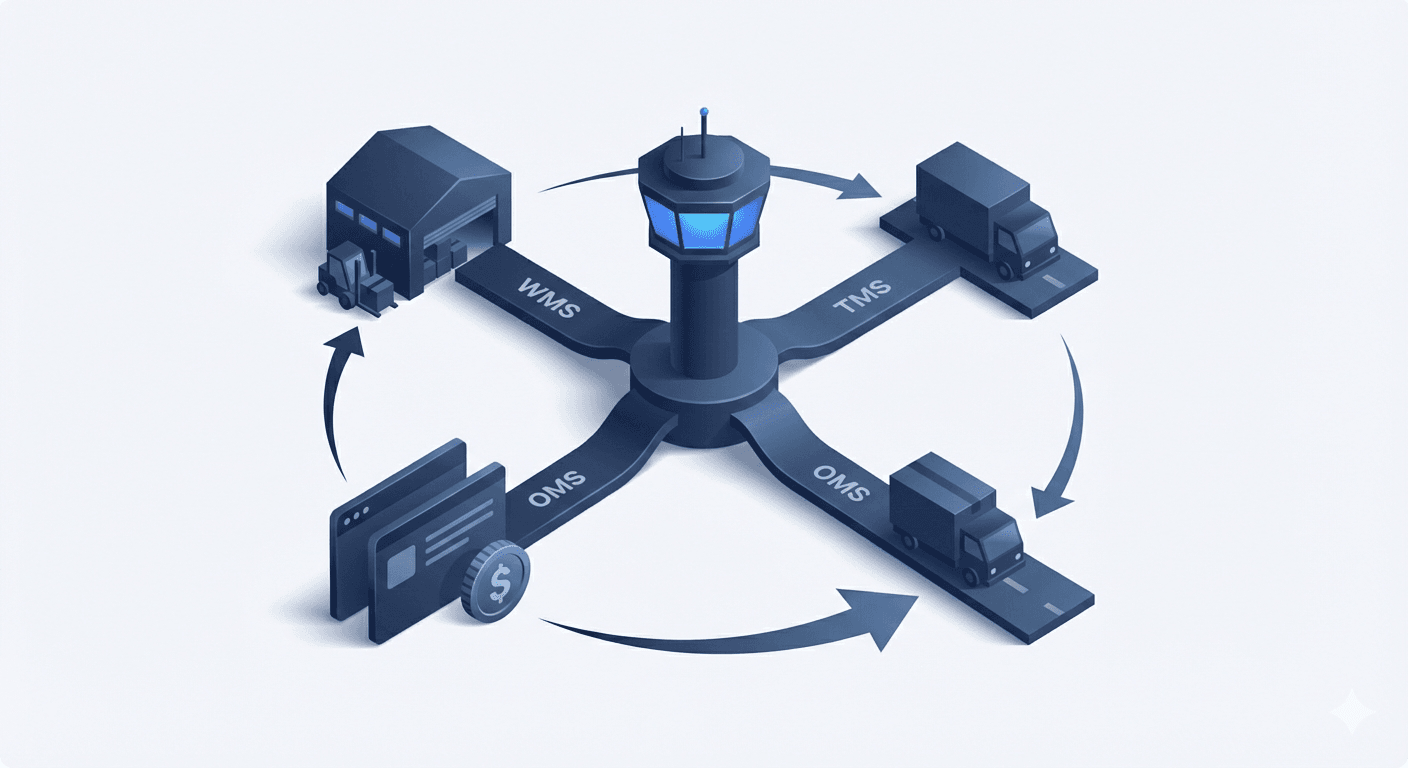

ERP (Enterprise Resource Planning) is a platform that combines all internal processes—such as purchasing, accounting, logistics, and inventory—into one unified system.

For finance and procurement, this means automating repetitive steps, reducing approval bottlenecks, and giving full visibility into what’s being spent, where, and why.

ERP bridges the gap between financial planning and operational execution.

The Procurement Problem: Why Legacy Tools Are Failing

Companies that rely on spreadsheets, email chains, and phone calls to manage purchases face several challenges:

- Purchase requests go missing or are delayed

- Budgets are exceeded due to lack of visibility

- Vendors send incorrect invoices or duplicate deliveries

- There is no standardised approval workflow

- Finance teams struggle with audit trails and reporting

In an economy driven by speed and competition, such inefficiencies are expensive—and risky.

ERP for Finance and Purchasing: What It Really Does

A purpose-built ERP system replaces disconnected processes with coordinated digital flows. Here's how it works in key areas:

Automatic Purchase Order Creation

In a connected system, POs no longer require multiple emails or paper forms. Instead, purchase requests are generated automatically when:

- Inventory falls below a defined level

- A department initiates a budgeted need

- A recurring contract renewal is due

- A sales order triggers restocking requirements

These POs are routed based on:

- Approval roles

- Budget availability

- Preferred suppliers

- Delivery locations

Once approved, the PO is shared with the vendor instantly.

This saves hours of manual effort and eliminates delays in procurement.

Real-Time Budget Monitoring

ERP tools allow businesses to control spending as it happens—not after the fact.

How?

- Budgets are assigned per department, location, or cost centre

- Each PO is linked to a budget category

- The system blocks or flags requests that exceed limits

- Budget dashboards show current usage, remaining funds, and trends

This helps finance teams catch issues before they grow—and helps managers make informed decisions about allocating future spend.

Vendor Portals for Transparent Collaboration

Managing vendors by email or PDF is prone to errors and delays.

ERP-based vendor portals give suppliers direct access to:

- New and existing purchase orders

- Delivery schedules and instructions

- Payment timelines

- Invoice upload and status tracking

- Document templates and compliance requirements

This reduces confusion, speeds up turnaround times, and builds trust between buyer and supplier—especially across borders.

In MENA markets, where supplier networks span countries, this feature is essential.

Controlled ERP Login for Accountability

ERP systems don’t give the same access to everyone. They are built around role-based logins.

This means:

- Procurement officers see only purchase-related data

- Finance teams manage budgets, payments, and audits

- Executives access reporting and analytics

- Vendors use limited external access to handle orders

Each action leaves a traceable record. This creates transparency, improves governance, and simplifies compliance reporting.

Real-Life MENA Scenario: Construction Supplies Company in Jeddah

Challenge:

A growing materials supplier was struggling to manage orders for over 200 clients and 50 vendors. Delayed POs, lost invoices, and overspent budgets were common.

Solution:

They adopted an ERP module focused on finance and purchasing. This included automated PO workflows, vendor self-service portals, and budget allocation by department.

Results:

- Purchase order creation time reduced by 70%

- Budget overruns dropped by 85%

- Vendor disputes fell to nearly zero

- Audits passed without penalty for the first time in 3 years

Core Benefits of ERP in Finance and Purchasing

| Feature | Business Benefit |

|---|---|

| Auto PO workflows | Faster approvals, fewer manual steps |

| Budget tracking | Avoids surprises, supports forecasting |

| Vendor portals | Easier collaboration, faster fulfilment |

| ERP login controls | Role-based access, improved accountability |

| Digital audit logs | Simplifies tax and financial reviews |

| MENA-friendly integrations | Arabic language support, local compliance tools |

Selecting the Best ERP Software: Key Factors

Not all ERP tools are equal. When evaluating the best ERP software for purchasing and finance, look for:

- User-friendly dashboards with real-time alerts

- Flexible approval rules by department or user

- Multi-language interface (Arabic + English)

- Region-specific tax and invoice settings

- Cloud or hybrid deployment for scalability

- Integration readiness with tools like Inventory Management and Order Management

Scalability and customisation are key—especially for MENA businesses navigating both growth and regulation.

Metrics That Prove ROI

Track the success of your ERP implementation by measuring:

- Average PO processing time

- % of spend within allocated budgets

- Vendor response speed

- Late delivery incidents

- Invoice matching accuracy

- Time saved in month-end reporting

A good system reduces time and cost—while improving accuracy.

Compliance & Reporting: Staying Ahead of Regulation

ERP tools also help businesses meet legal and financial obligations, especially in jurisdictions such as:

- KSA: ZATCA’s e-invoicing requirements

- UAE: VAT compliance and audit trail expectations

- Egypt: National electronic invoice regulations

By using a platform that logs all actions and documents digitally, you stay compliant without extra admin effort.

Avoid These ERP Mistakes

- Underestimating training needs: Without user understanding, even the best system fails.

- Choosing ERP without localisation: Generic tools may not support Arabic or MENA tax rules.

- Delaying integration: ERP must connect to inventory, sales, and warehousing systems to add full value.

- Ignoring vendor readiness: If your vendors can't access or understand the portal, adoption drops.

- Setting weak approval controls: Too much access or unclear workflows lead to errors and fraud.

Avoiding these missteps ensures smooth ERP adoption and stronger long-term results.

Future of ERP in MENA: What’s Next?

Digital transformation is not slowing down. In the next 3–5 years, we expect:

- AI-driven purchasing recommendations

- Automated fraud detection in POs and invoices

- Dynamic budgeting that adjusts with sales or market trends

- Smart vendor scoring based on reliability and performance

- E-wallet integrations for instant vendor payments

MENA businesses that lay their ERP foundation today will be ready for tomorrow’s innovation.

Ready to Take Control of Finance and Procurement?

From better vendor communication to faster approvals and smarter budgeting, ERP delivers what spreadsheets and legacy systems cannot.

Whether you're a growing SME or an enterprise with hundreds of vendors, ERP turns complexity into clarity—and costs into strategy.

See ERP in Action

💼 Streamline Procurement with Omniful OMS

📊 Control Spend with Inventory Integration

🔗 Connect ERP with All Key Platforms

FAQs

Is ERP login secure for financial data?

Yes. ERP platforms use encrypted access, role-based controls, and activity logs to ensure data privacy and protection.

Can ERP systems support Arabic invoices?

Many modern ERPs offer bilingual templates and localised tax support for Saudi Arabia, UAE, and Egypt.

Do ERP tools integrate with warehouse operations?

Yes. You can link with Warehouse Management Systems for full procurement-to-fulfilment visibility.

Is ERP too complex for smaller businesses?

Not at all. Scalable modules allow you to start small—then grow as needed.

What makes Omniful different?

Omniful offers seamless integration with existing tools, regional expertise, and a user experience tailored for the MENA market.