Expanding Global Sales with E-Invoicing Compliance: A Strategic Guide

Table of Contents

Fast Track to Compliance: Key Takeaways for Global Sellers

- E-invoicing is now a global tax standard, not just a regional need.

- ZATCA e-invoicing leads GCC digital compliance, impacting Saudi Arabia-based businesses.

- Focus Accounting Software supports streamlined integration for e-invoice compliance.

- Global expansion demands tax uniformity—compliance ensures smoother entry into new markets.

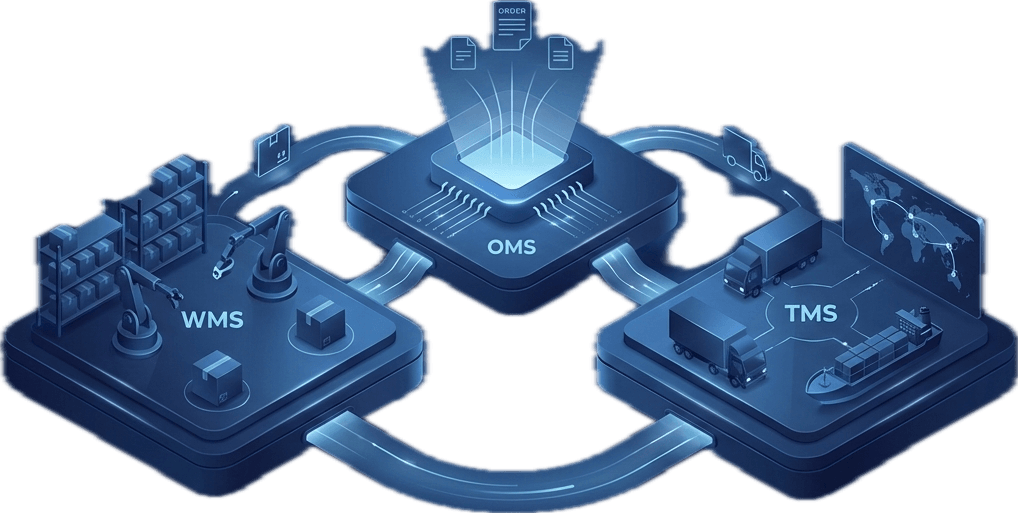

- Omniful’s Point of Sale & Order Management System help automate invoicing and reporting.

- From onboarding to cross-border returns, Omniful supports end-to-end compliance.

The Global E-Invoicing Movement

Global businesses are rapidly moving towards digital tax compliance. E-invoicing is no longer optional—it is becoming a requirement across regions, particularly in the MENA zone.

For companies selling into or expanding across borders, meeting local tax regulations is critical. These include mandatory invoice submission, real-time government reporting, and format standardisation.

One of the most advanced regulatory frameworks is ZATCA e-invoicing in Saudi Arabia, which has become a blueprint for other countries in the Gulf Cooperation Council (GCC). ZATCA (Zakat, Tax and Customs Authority) introduced the first wave in December 2021, followed by tighter Phase Two requirements from January 2023.

ZATCA mandates not just issuing digital invoices, but also reporting them through pre-approved platforms. Any business hoping to operate in Saudi Arabia must now align with these rules.

Why International Markets Are Tightening Tax Regulations

Countries around the globe are tightening tax rules to prevent fraud, improve transparency, and digitise business ecosystems. According to a report by the OECD, over 60 countries have adopted e-invoicing frameworks, with real-time data submission now expected by tax authorities.

The implications for exporters, importers, and global retailers are significant. Compliance is no longer just about good accounting practice—it’s a legal necessity. This trend impacts sellers operating in:

- UAE (Federal Tax Authority mandates electronic submission),

- India (GSTN e-invoicing for B2B transactions),

- Europe (many countries require Peppol-compliant submissions),

- Latin America (Brazil, Mexico lead with strict digital invoice laws).

For businesses in MENA, ZATCA serves as the compliance benchmark. Aligning now helps smooth expansion into nearby regulated markets.

ZATCA E-Invoicing: What You Must Know

ZATCA e-invoicing requirements fall into two phases:

Phase One – Generation

Businesses must generate electronic tax invoices using a compliant system like Focus Accounting Software or Omniful’s POS solution. The system must:

- Include mandatory invoice fields

- Generate QR codes

- Avoid manual edits after issuance

Phase Two – Integration

This phase requires integration with ZATCA’s Fatoora platform for invoice sharing. Features include:

- Cryptographic stamping

- UUID generation

- XML format compliance

- Invoice archiving

Non-compliance may result in fines or business restrictions.

Omniful’s Plug and Play Integrations ensure that businesses can link accounting, e-commerce, and ERP systems with tax platforms like ZATCA easily.

The Role of Focus Accounting Software in E-Invoicing

Focus Accounting Software offers automation features ideal for businesses transitioning into e-invoicing. Key features include:

- Auto-generation of tax-compliant e-invoices

- Multi-currency support for international sales

- Seamless integration with government portals

- Batch processing of invoices and returns

It’s particularly effective for MENA-based enterprises who must handle GCC-wide tax laws while expanding globally.

When paired with Omniful’s Order Management System, the result is full automation—from invoice generation to cross-border shipping and returns.

Scaling Compliance Across Borders

Expanding into international markets requires scalable solutions. Manual methods can't handle region-specific tax structures and digital mandates.

Here’s how you scale smartly:

- Centralise tax compliance: Use systems that support multi-region formats like XML, UBL, or JSON.

- Integrate compliance with operations: Automate via OMS, POS, or ERP platforms.

- Leverage compliance-ready returns: Use Returns Management systems with regional tax refund handling.

- Handle multi-country tax thresholds: Align thresholds for VAT, sales tax, and customs duties.

Omniful supports global invoicing standards and integrates seamlessly with shipping gateways and supply chain tools, making it ideal for exporters and importers in the MENA region.

Omniful: Simplifying Global Tax Compliance

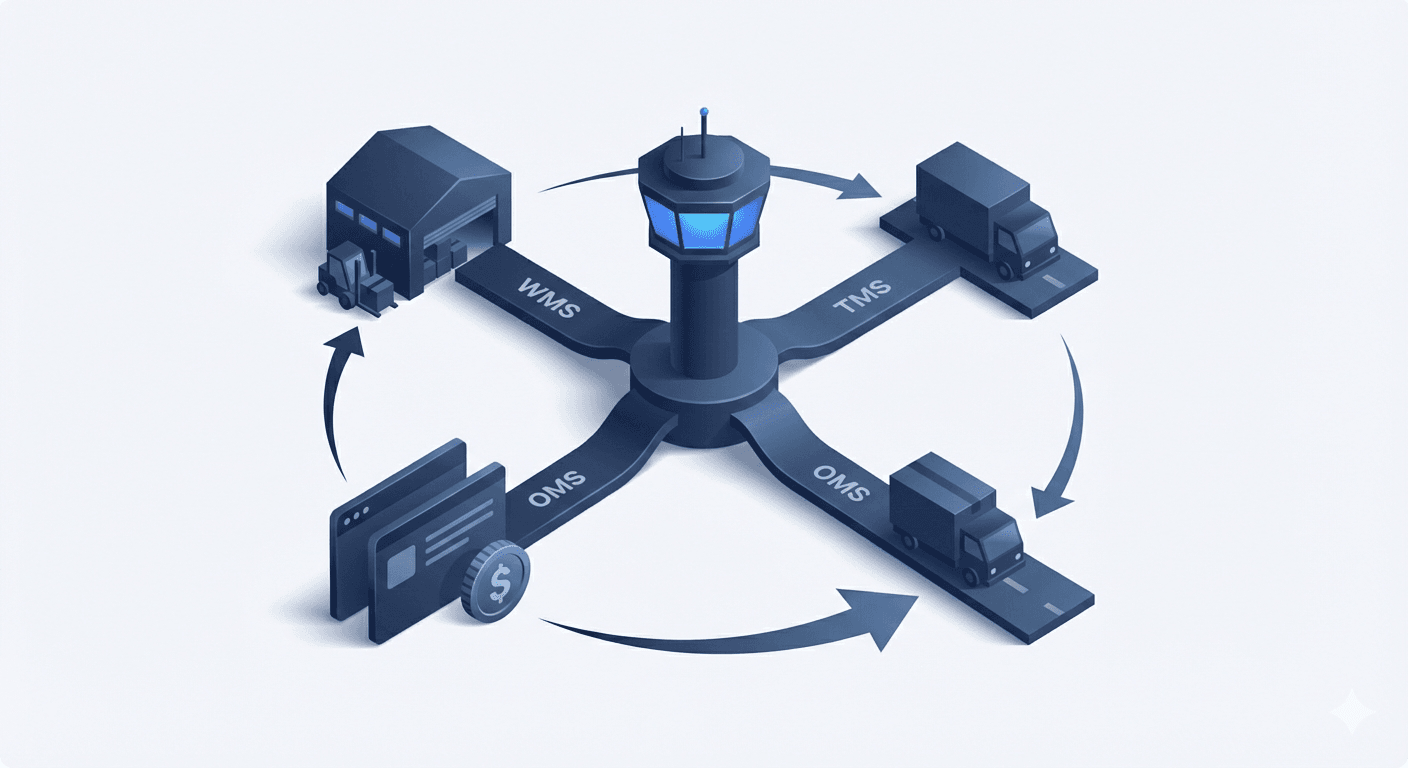

From Riyadh to the world, Omniful helps brands meet ZATCA and global tax regulations through an integrated suite of tools:

- Warehouse Management: Enables precise order tagging and item tracking.

- Inventory Management: Keeps real-time stock data for accurate invoice generation.

- Transportation Management: Supports dynamic route planning and cost allocation by region.

- Shipping Gateway: Automates document generation and airway bills per regulatory format.

The advantage? One platform for end-to-end visibility and compliance—minimising errors and audit risks.

Future-Proofing E-Invoicing Compliance

Digital tax mandates will only grow stricter. The more countries businesses sell into, the greater the variation in e-invoice structures and submission timelines.

Invest now in flexible platforms that offer:

- API support for tax authority sync

- XML/UBL compliance by region

- Real-time data validation

- Cross-border payment reconciliation

With AI-powered demand forecasting and invoice matching coming soon, platforms like Omniful will further enhance compliance while driving operational efficiency.

Common Challenges in Global E-Invoicing

Businesses face several obstacles when trying to comply across markets:

- Lack of standardisation: Each country demands different formats.

- Manual errors: High risk of penalties due to data mismatch.

- Integration complexities: ERPs may not align with tax APIs.

- Return complexity: Handling tax credits or adjustments for returned goods.

Solutions lie in automation. Systems like Omniful’s POS and Returns Management address these by syncing invoice data with return activities and shipping details.

Strategic Recommendations

If you're preparing to enter or expand in new markets, follow these steps:

- Audit your current invoicing workflows.

- Map local tax laws of target countries.

- Choose systems like Focus Accounting Software that support e-invoice APIs.

- Implement multi-layer integration with platforms like Omniful.

- Ensure your warehouse, return, and shipping data feed into your invoicing system.

Taking a proactive approach avoids legal pitfalls, streamlines operations, and positions your brand as a trusted seller in new territories.

Frequently Asked Questions

How does ZATCA impact foreign sellers in Saudi Arabia?

Foreign sellers must issue and report e-invoices via local representatives or compliant digital systems like Omniful.

Is Focus Accounting Software compliant with international standards?

Yes. It supports XML, UBL formats and integrates with government tax portals in multiple countries.

How can Omniful help with VAT compliance in multiple countries?

Omniful automates invoice tagging by region, supports varied tax fields, and syncs with shipping gateways for border-level VAT calculations.

What if my return item needs a tax adjustment?

Using Returns Management, tax reversals or credits are applied automatically to your invoice history.

Do I need separate systems for each country I sell in?

Not with Omniful. It offers modular solutions that adapt to regional needs, centralising data across sales and tax channels.

Ready to Scale Globally with Confidence?

E-invoicing is the key to accessing regulated markets. Whether you're already selling internationally or just starting, compliance should be built into your operations from Day One.

Explore how Omniful can help simplify your global expansion, from ZATCA to the rest of the world.