Mastering Inventory Turnover: The Key to Smarter Warehousing and Cash Flow Gains

Table of Contents

In a world where supply chain efficiency defines profit margins, inventory turnover isn't just a number—it’s your silent strategist. For brands operating in competitive markets like the GCC or MENA region, where warehousing costs are rising and demand is shifting rapidly, knowing how to calculate inventory turnover and act on it can redefine your entire operation.

Let’s break down what this term really means, how to measure it accurately, and what you can do to keep your turnover rate lean and profitable with the help of a strong inventory management system for warehouse operations.

QuickClarity: Your Inventory IQ Booster

What you’ll learn here:

- What inventory turnover is and why it matters.

- The simple formula to calculate it.

- Real-world strategies to improve it.

- How a warehouse inventory management system can unlock faster cash flow.

What Is Inventory Turnover and Why Should You Care?

Inventory turnover measures how often your stock is sold and replaced in a set timeframe. It shows the relationship between inventory levels and sales performance. A high turnover rate suggests products move quickly—great for cash flow. A low rate? It signals overstocking, ageing products, and blocked capital.

In today’s digital-first markets, especially in Saudi Arabia and the UAE, poor inventory turnover often ties back to outdated warehousing practices. Businesses holding too much stock for too long face inflated storage fees and missed revenue opportunities.

The Formula: How to Calculate Inventory Turnover

Here’s a straightforward way to find your inventory turnover ratio:

Inventory Turnover Ratio = Cost of Goods Sold (COGS) / Average Inventory

- COGS: The direct cost of producing or purchasing the products you've sold.

- Average Inventory: (Beginning Inventory + Ending Inventory) / 2

Example: If your COGS for the year is $1,000,000 and your average inventory is $250,000:

Inventory Turnover = 1,000,000 / 250,000 = 4

This means you’ve turned over your stock four times in the year.

What’s a Good Inventory Turnover Rate?

It depends on the industry. Fast-moving sectors like FMCG might aim for 10+, while luxury goods may be closer to 3. For the MENA retail landscape, especially in omnichannel businesses, a turnover of 5-8 is usually healthy.

But more than a number, it’s about balance—holding just enough stock to meet demand without overstocking and risking waste or obsolescence.

The Hidden Cost of Low Inventory Turnover

Stock that sits too long eats into your profits. Here’s how:

- Higher warehousing costs: Especially in dense urban zones like Riyadh or Dubai, storage is premium.

- Obsolescence: In sectors like electronics or beauty, products lose value fast.

- Cash flow crunch: Money tied up in unsold stock can't be reinvested elsewhere.

Low turnover is also a red flag for larger issues—maybe inaccurate demand forecasting, weak promotions, or poor product-market fit.

Fixing the Problem: Practical Ways to Improve Inventory Turnover

Improve Forecasting Accuracy

Use past sales data, seasonality, and AI-powered tools to predict demand. This helps avoid both overstocking and stockouts.

Rationalise Your Product Range

Not every SKU deserves shelf space. Review and trim slow-movers to make room for high-demand items.

Optimise Reorder Points

With a smart warehouse inventory management system, you can set dynamic reorder levels based on real-time demand and lead times.

Strengthen Supplier Relationships

Quick restocking depends on reliable suppliers. Build strong vendor partnerships to reduce lead times and improve stock efficiency.

Embrace Real-Time Inventory Visibility

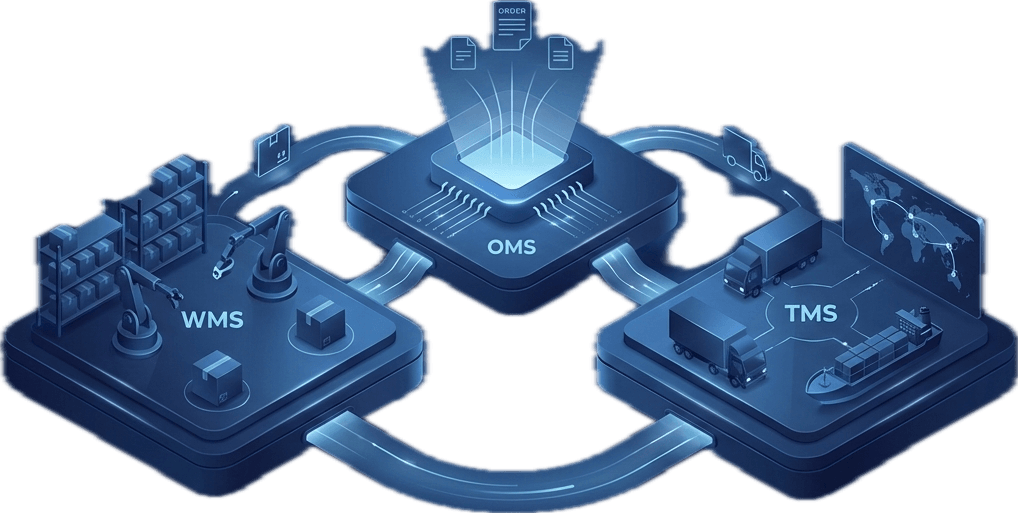

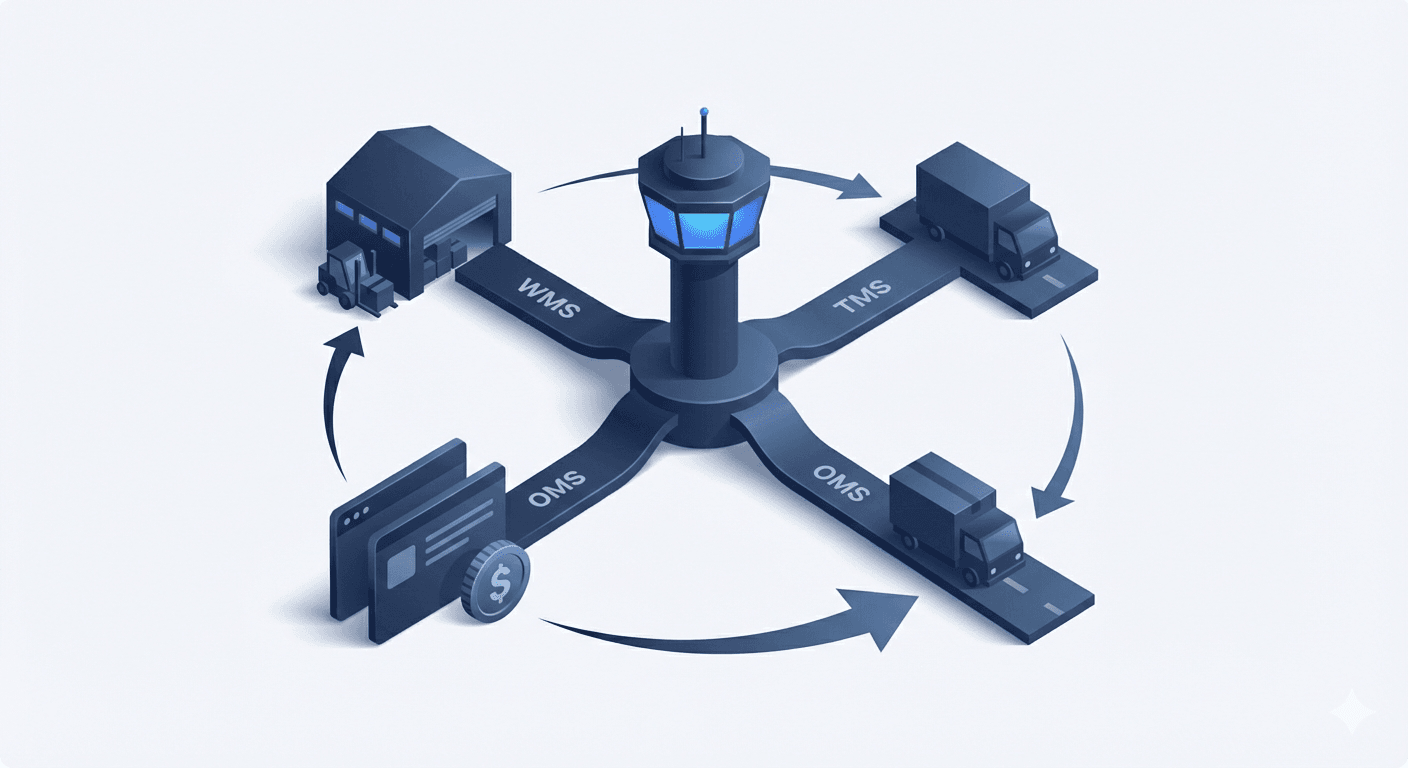

Using a real-time warehouse inventory management system lets you monitor what’s available, incoming, and reserved across multiple hubs—critical for maintaining optimal turnover rates.

The Tech Advantage: Why a Warehouse Inventory Management System Is Essential

Platforms like Omniful’s Inventory Management System offer enterprise-grade features that radically boost turnover rates:

- Real-time stock sync across sales channels

- Batch & expiry tracking for perishables

- Multi-hub inventory tracking

- SKU cycle counting for accuracy

- Inventory adjustment directly from a mobile app

These tools are particularly valuable in MENA markets, where logistics infrastructures can vary greatly between cities or countries.

How Better Inventory Turnover Drives Cash Flow

When stock moves faster:

- You get quicker returns on investment.

- Less money is locked in inventory.

- You reduce markdowns and clearance losses.

In essence, better turnover equals better cash control. And cash, as they say, is king—especially in supply chains.

See Omniful in Action

Want to transform your inventory turnover into a cash flow catalyst?

👉 Request a demo with Omniful today

Let our real-time, omnichannel warehouse inventory management system show you how operational excellence is done.

FAQs: Getting Clarity on Inventory Turnover

How often should I measure inventory turnover?

At least quarterly, though monthly monitoring is ideal for fast-moving sectors.

Can high turnover be a bad thing?

Yes, if it leads to stockouts or frequent reordering costs. Always match turnover with customer demand.

How does warehouse layout affect turnover?

Efficient layouts reduce picking time and help fast-moving goods get out the door quicker.

Is inventory turnover more important than profit margin?

They go hand-in-hand. Low turnover can hurt cash flow even if margins are good.

What’s the difference between turnover and sell-through?

Sell-through measures sales against received stock, while turnover considers inventory carried over time.