Tax E-Invoicing Made Simple: Your Complete Guide to Compliance and Integration

Table of Contents

A Quick Dive into E-Invoicing Essentials

- E-invoicing is now a legal must in Saudi Arabia, enforced by ZATCA.

- Companies must use certified accounting tools like Focus Accounting Software.

- Digital invoices improve tax filing accuracy and build financial trust.

- Systems must link directly to government platforms for real-time validation.

- Ignoring e-invoicing rules risks penalties, fines, and business disruption.

Why E-Invoicing Matters More Than Ever

The move to electronic invoicing is reshaping how businesses across Saudi Arabia and the wider MENA region handle taxes. What was once a manual, paper-heavy task is now digital, automated, and under strict regulatory oversight.

In Saudi Arabia, the Zakat, Tax, and Customs Authority (ZATCA) has made it mandatory for businesses to adopt e-invoicing. Companies need to not only generate invoices electronically but also integrate their systems with government portals.

If businesses want to stay compliant, avoid fines, and maintain smooth operations, adopting a reliable e-invoicing solution is non-negotiable.

What Is an E-Invoice?

An e-invoice is not just a digital copy of a paper invoice. It is created, transmitted, and stored electronically in a format approved by regulatory bodies like ZATCA.

This format ensures that the invoice:

- Is tamper-proof.

- Can be validated in real-time.

- Can be archived safely for tax audits.

E-invoicing is about protecting the tax ecosystem. It closes gaps that fraudsters once exploited and helps governments track commercial activity in a smarter way.

The Role of ZATCA in E-Invoicing

ZATCA has issued clear e-invoicing regulations in Saudi Arabia. There are two stages:

First Stage – Generation and Archiving:

Businesses must issue digital invoices with secure features. No more handwritten or manually edited invoices.

Second Stage – Integration:

Businesses must link their invoicing systems to ZATCA’s platform. Every invoice issued must be validated and cleared by the authority in real-time.

Both phases aim to make tax reporting more accurate and transparent.

How Focus Accounting Software Simplifies E-Invoicing

Finding a system that makes compliance easy is key. Focus Accounting Software is designed to help companies meet ZATCA's rules without struggling through technical challenges.

Here’s how Focus can help:

- Pre-Built Compliance: The platform is already certified to work under ZATCA’s e-invoicing rules.

- API Connectivity: Invoices are automatically sent to ZATCA for real-time validation.

- Automatic VAT Calculation: No more manual tax errors.

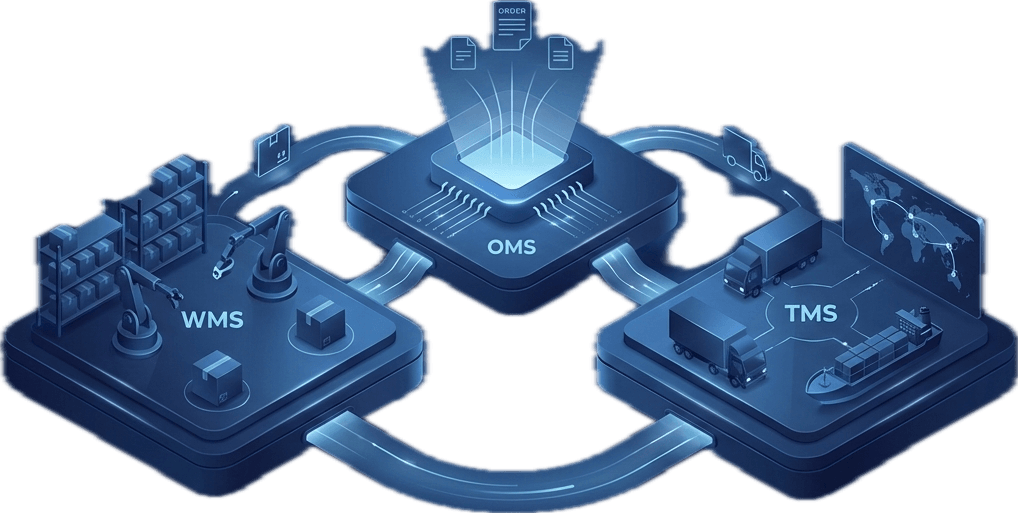

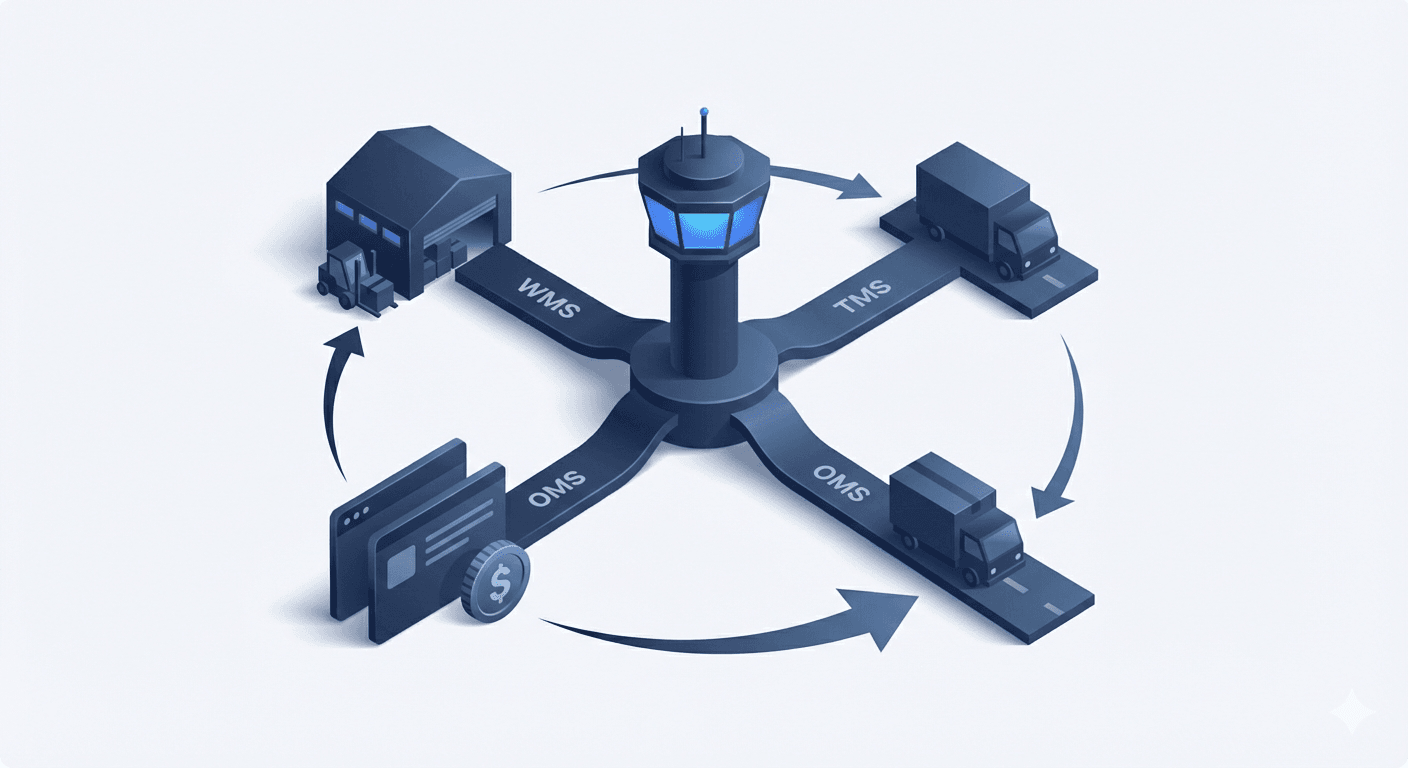

- ERP Integration: Finance, sales, and inventory modules connect directly to e-invoicing functions.

- Digital Signatures: Secure and authenticate invoices easily.

This integration saves time, reduces mistakes, and ensures businesses stay audit-ready.

Why E-Invoicing Is Good for Business

Faster Payments: Electronic invoices can be processed and paid quicker than traditional ones. No postal delays. No paperwork lost in transit.

Fewer Errors: Automated data validation reduces common mistakes like wrong VAT numbers or miscalculated totals.

Stronger Customer Relationships: Clients trust businesses that operate transparently. E-invoicing shows professionalism and reliability.

Improved Cash Flow: Quicker invoice generation and payment cycles mean healthier cash flow for businesses.

Common Challenges in E-Invoicing Implementation

Legacy Systems: Older accounting software may not be compatible with new digital requirements. Companies might need to upgrade or switch platforms.

Data Security: E-invoicing deals with sensitive financial information. Strong cybersecurity measures are critical to prevent breaches.

Staff Readiness: Teams must be trained to work with new processes. Change management is just as important as system upgrades.

Vendor Selection: Choosing a reliable e-invoicing partner, like Focus Accounting Software, is key to ensuring compliance without future headaches.

Steps to Achieve ZATCA E-Invoicing Compliance

1. Evaluate Your Current Systems

Identify if your invoicing platform supports ZATCA integration and secure digital signatures.

2. Select the Right E-Invoicing Partner

Solutions like Focus Accounting Software already meet compliance needs and offer easy integration.

3. Plan for Integration

Prepare your ERP, CRM, and POS systems to communicate with your e-invoicing platform.

4. Train Your Team

Ensure employees know how to issue, validate, and archive e-invoices.

5. Test and Go Live

Start issuing e-invoices in a controlled environment before going fully live.

What Happens If You Ignore E-Invoicing?

Non-compliance with e-invoicing laws is not taken lightly.

Companies that fail to comply may face:

- Fines starting from SAR 5,000 and increasing with repeated offences.

- Business license suspension or revocation.

- Blacklisting from future government contracts.

- Reputational damage among clients and partners.

Beyond Saudi Arabia: E-Invoicing Across the MENA Region

Saudi Arabia is leading the charge, but other MENA countries are also moving towards mandatory e-invoicing.

For example:

- Egypt has already mandated e-invoicing for large companies.

- United Arab Emirates is exploring similar frameworks.

- Bahrain is preparing tax digitalisation policies.

Adopting e-invoicing today not only secures your business in Saudi Arabia but also prepares it for regional growth.

Future Trends in E-Invoicing

Blockchain-Based Invoices:

Future systems may use blockchain technology for even greater security and authenticity.

AI-Driven Tax Insights:

Artificial Intelligence will likely help predict tax liabilities and identify potential errors before audits happen.

Cross-Border Standardisation:

Expect to see international efforts to standardise e-invoicing protocols, making trade between MENA and Europe smoother.

Real-Time Reporting:

Tax authorities will increasingly demand real-time invoice sharing and tax filings, reducing the need for manual submissions.

Final Thoughts: A Digital Leap Your Business Cannot Avoid

E-invoicing is not just a government mandate.

It is an opportunity for businesses to become more efficient, secure, and globally competitive.

By choosing a solution like Focus Accounting Software, businesses can:

- Stay compliant with ZATCA rules.

- Reduce manual work.

- Improve operational efficiency.

- Enhance client and regulatory trust.

The move to digital is happening fast. Make sure your business is ready to ride the wave, not drown under it.

FAQs About E-Invoicing

Is e-invoicing compulsory for small businesses?

Yes, if your annual revenue crosses ZATCA’s defined threshold, you must comply, regardless of company size.

Do I need a separate portal to issue e-invoices?

No. Certified software like Focus Accounting Software integrates everything in one platform.

How are e-invoices archived?

Invoices must be stored digitally and securely for a minimum number of years, as specified by ZATCA.

Will ZATCA update their requirements?

Yes. It’s important to stay connected with your software provider to receive timely system updates.