Returns Fraud Prevention: Tracking Patterns, Verifying Receipts, and Data-Driven Detection

Table of Contents

Strengthening Retail Integrity in MENA with Smarter Returns Oversight

Returns are a natural part of commerce. But when those returns are manipulated, fabricated, or abused, businesses don’t just lose products—they lose trust, revenue, and operational control.

Across the Middle East and North Africa (MENA), retailers are seeing a rise in return abuse—a complex issue that impacts large chains and small businesses alike. Fraudulent return activities are evolving, often hiding behind seemingly legitimate processes.

This blog provides a complete overview of how businesses can use modern returns management strategies to detect refund abuse, block bad actors, and reinforce healthy customer relationships using advanced, transparent, and ethical tools.

Quick Bytes for Busy Minds

- Return fraud is rising across MENA, particularly during sale seasons.

- Abusers exploit gaps in policies, receipts, and inventory visibility.

- Behaviour tracking, digital receipts, and system rules help prevent loss.

- Data-backed systems provide real-time flags before abuse becomes widespread.

- Omniful’s Returns Management platform includes prevention tools designed for omnichannel commerce.

The Growing Problem of Return Fraud in the Region

While flexible return policies increase consumer trust, they also open doors to individuals exploiting these policies for personal or financial gain.

Real fraud cases include:

- Item substitution: Returning a cheaper or damaged product in place of the purchased one.

- Receipt duplication: Using forged or copied proof of purchase to secure refunds.

- Wardrobing: Using items temporarily (e.g., clothing, electronics) before returning them.

- Return cycling: Ordering and returning the same item repeatedly for promotional or credit benefits.

- Multiple identity returns: Using different profiles to bypass limits and flagging systems.

In MENA’s retail hotspots—from Dubai malls to online marketplaces in Saudi Arabia—businesses face losses that are difficult to quantify but impossible to ignore.

Where Retailers Are Losing Control

Return fraud is difficult to contain because it often hides behind real purchases and customer rights. Without structured oversight, merchants struggle to separate honest customers from those gaming the system.

Challenges include:

- Lack of digital proof: Many businesses still rely on paper receipts.

- Inconsistent policies: Physical stores and online platforms have unaligned workflows.

- No customer tracking: Walk-in buyers remain anonymous across transactions.

- Manual verifications: Staff are often unequipped to detect clever forms of abuse.

- Inventory misalignment: Returns are not reconciled against warehouse counts.

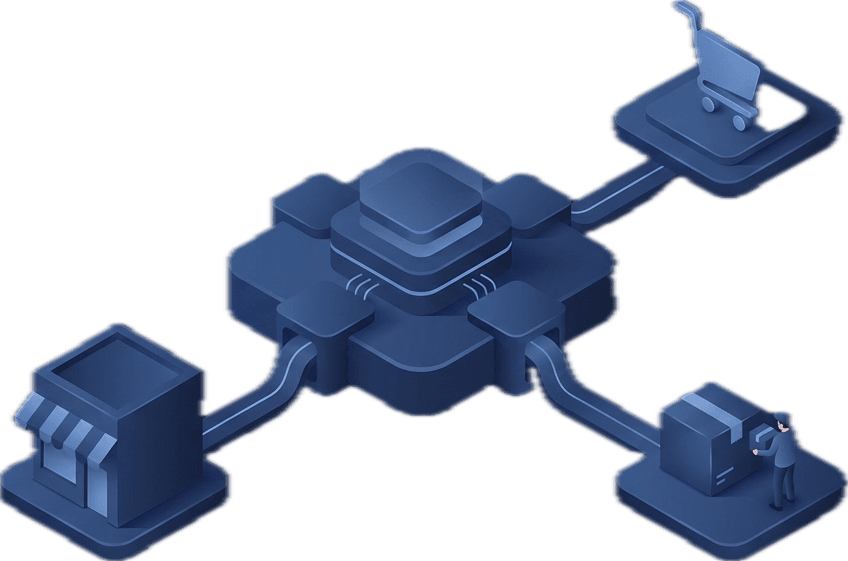

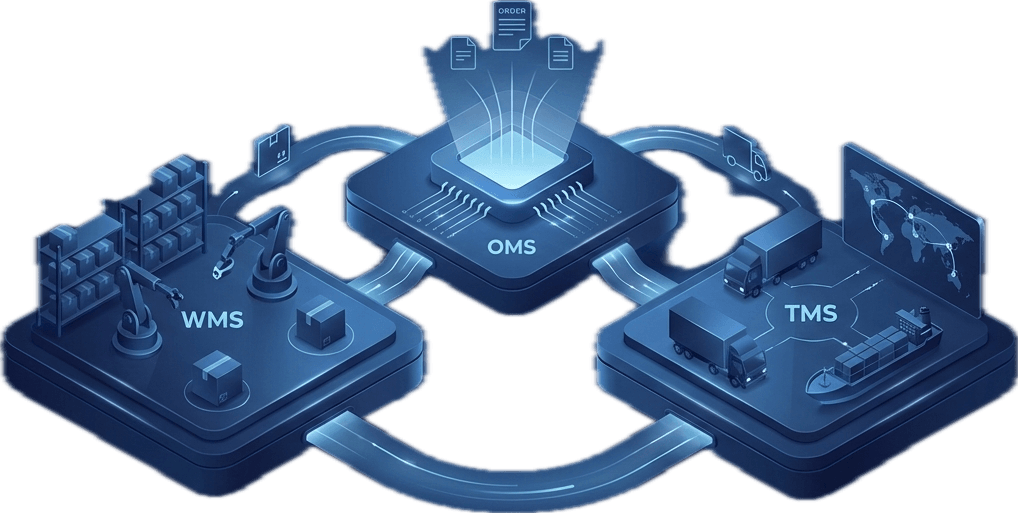

A robust returns management solution bridges these gaps, linking payment history, customer identity, and return actions into a cohesive picture.

Building the Foundation for Fraud Prevention

Stopping fraud begins with three pillars: visibility, verification, and vigilance. Each of these can be supported by structured tools and workflows that prioritise transparency.

Pillar 1: Visibility – See the Whole Picture

You cannot prevent what you cannot see. Many fraud attempts are missed because there is no consolidated view of return history, customer habits, or item movement.

What to implement:

- A single system to log every return, regardless of channel

- Link every transaction to a customer profile (email, phone, loyalty number)

- Integrate online and in-store sales data for pattern analysis

- Match returns to actual product IDs to detect substitutions or fake returns

With a system like Omniful’s Order Management, data from various touchpoints is connected in one view—allowing better fraud detection.

Pillar 2: Verification – Trust, But Validate

Customers deserve convenience, but businesses deserve certainty. Automatically validating returns ensures that real purchases are returned and fake receipts are flagged.

Recommended tactics:

- Digital receipts: Automatically issued and stored on the customer account

- Barcode scanning: Use item-specific barcodes to link each product to its transaction

- Receipt match checks: Ensure return details match the original purchase (time, location, SKU)

- Restricted return windows: Return periods should be consistent, fair, and enforced

The Returns Management platform from Omniful helps enforce these checks with minimal manual steps.

Pillar 3: Vigilance – Track Behaviour Over Time

Not all fraud happens in a single transaction. Often, patterns reveal themselves over time—through customer behaviour, product trends, or anomalies in return frequency.

Behavioural tracking tools to consider:

- Monitor return-to-purchase ratios by customer

- Flag accounts with unusually high returns on specific SKUs

- Detect multiple returns from the same address but different names

- Evaluate return reasons—frequent ‘defective’ claims may be suspicious

- Auto-blacklist serial abusers using score-based thresholds

When businesses layer behavioural data with transactional records, return fraud becomes easier to detect and manage.

Real Example: Mid-Size Fashion Retailer in Saudi Arabia

The Problem:

The brand offered a generous 14-day return policy both online and in-store. But they began noticing frequent complaints around missing inventory, mismatched product labels, and refund losses after seasonal sales.

Their Action Plan:

- Replaced paper receipts with digital confirmation

- Enforced barcode match verification at all POS and return counters

- Linked loyalty IDs to every transaction

- Used Omniful’s platform to track repeat refund claims by user

Results After 6 Months:

- Return fraud dropped by 40%

- Inventory shrinkage due to fraud was cut in half

- 78% of returns processed through digital workflows

- Refund approval time reduced by 30%

- Customer trust scores improved in satisfaction surveys

Real-Time Data Checks That Make a Difference

The true power of a returns platform lies in its ability to process, filter, and flag anomalies instantly.

Features you should look for:

| Function | Impact on Fraud Prevention |

|---|---|

| Customer return history | Flags abnormal frequency or patterns |

| SKU-level return reasons | Spots abuse by product category |

| Payment method matching | Verifies refunds against original source |

| Location-based return logs | Detects unusual channel-switch behaviour |

| Real-time notifications | Alerts staff to escalated return actions |

By configuring fraud rules to match your business logic, you control what’s allowed—and what isn’t—across your entire retail network.

Don’t Let Friendly Fraud Erode Your Margins

Not all fraud is malicious. Some customers genuinely misunderstand policies or exploit loopholes unintentionally.

How to fix this:

- Clear return rules: Make them easy to understand, both online and offline

- Guided return flows: Help customers through each step, preventing errors

- Refund alternatives: Offer store credit to reduce cash losses

- Auto-receipt delivery: Send digital confirmation with every order

- Restrict promo abuse: Tie discounts and loyalty credits to non-returned items

Return abuse isn’t just about criminal activity—it’s often enabled by vague terms or weak enforcement. Fixing the basics builds your foundation.

Training Staff to Spot Red Flags

Technology supports your team—but doesn’t replace them. Equipping staff with awareness of fraud risks helps prevent abuse at the frontline.

Train your staff to:

- Ask for digital receipts or customer ID during returns

- Verify barcode and SKU match with return records

- Recognise signs of tampering, re-sealing, or excessive wear

- Politely escalate cases where records are missing or inconsistent

- Document every return—even the fast ones

A returns policy backed by trained teams and data tools is your strongest defence.

Returns Policy: Your First Line of Defence

Even with the best systems, unclear policies can leave gaps for exploitation. Review your return terms to ensure they support fraud control.

Key policy features:

- Specific return timeframes by category

- Limits on item condition (sealed, unworn, unused)

- Refund method based on original payment

- Proof of purchase required (receipt, order ID, loyalty number)

- Exclusions for clearance or promotional goods

- Explanation of consequences for abuse

A transparent returns process is not just fair—it’s protective.

Monitor and Improve with Data

Success isn’t about eliminating all returns—it’s about reducing avoidable losses.

Track these KPIs regularly:

- % of returns flagged for review

- Top 5 return reasons by value

- Refund request vs. approval ratio

- Product categories with highest abuse

- Cost of fraudulent returns per quarter

- Revenue saved from detected fraud attempts

Omniful’s analytics suite visualises these trends, empowering you to adjust policies and workflows as your business evolves.

Reclaim Control Over Returns—Without Losing Good Customers

Returns fraud doesn’t mean you need to become rigid. With the right tools, you can offer fair return options, process genuine requests quickly, and stop abuse before it spreads.

Returns don’t need to hurt your business. Managed well, they can be a competitive edge.

Get Started with Smarter Return Management

🛡️ Explore Omniful’s Returns Management Tools

📊 Track Fraud Patterns with Real-Time Data

🧾 Integrate Inventory with Verified Returns

FAQs

Can I block specific customers from returning?

Yes. With pattern tracking, you can flag and limit users based on frequency, abuse, or return reasons.

Is fraud more common online or in-store?

Both. However, fraud often crosses channels—buying on one, returning on another. Omnichannel tools help detect these shifts.

How do I balance fraud prevention with customer experience?

Clarity is key. Make your return terms visible, use polite prompts, and let your systems handle most of the work in the background.

Can I apply different return rules to different product types?

Absolutely. With a system like Omniful, you can customise policies by product, season, customer tier, and more.